USD/MXN Forecast: Bullish

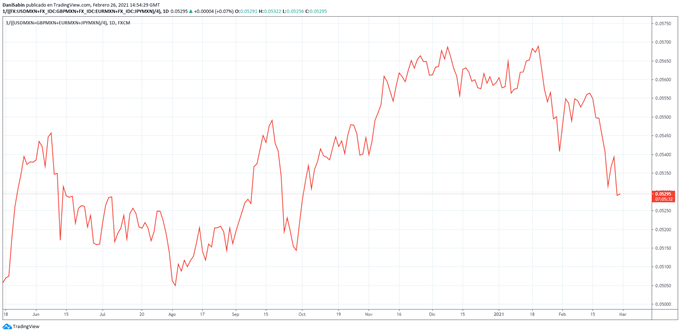

Emerging currencies had their worst day in months on Thursday, with the Mexican Peso leading the losses as rising bond yields tore through LatAm assets.

MXN against a basket of currencies (USD, GBP, EUR, JPY)

USD/MXN rose to its highest level in 3 months despite better than expected fourth-quarter growth numbers for Mexico, highlighting that bond yields are running the show for now. And higher rates are likely still to come, putting bond-sensitive currencies like the Mexican Peso at risk, especially since high domestic interest rates have made the Peso more vulnerable to global borrowing costs.

The Mexican currency was already in a weak position coming off the back of last week, with power disruptions from Texas affecting local factories and households, and bringing in stronger state control over the electricity market.

The U.S. 10-year Treasury yield peaked at a high of 1.6140 overnight on Friday after the latest 7-year auction left dealers with more bonds than anticipated in their hands, pointing at further weak demand, as vaccination programs and increase fiscal and monetary stimulus have left investors expecting a quicker economic recovery and rising inflation expectations. This sharp rise in yields has put downward pressure on stocks, releasing an overall negative market sentiment, which has affected risk-on assets like the Mexican Peso, whilst traditional safe-haven assets like the US Dollar are being bought.

I expect this to be the predominant theme in global markets next week, which means that USD/MXN is likely to see further buying pressure if yields continue to rise.

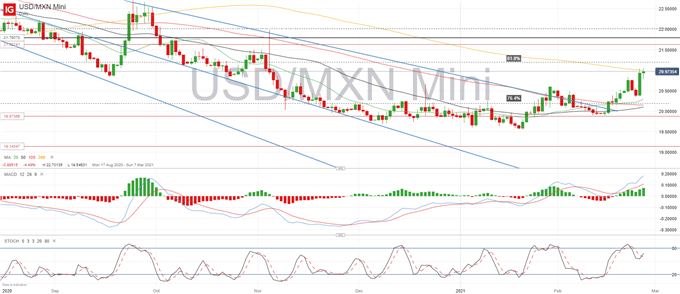

USD/MXN Daily Chart

Looking at the daily chart, USD/MXN is now looking increasingly bullish in the short-term, with a rising MACD divergence and the stochastic oscillator rising towards the overbought territory. I expect the pair to continue moving in line with overall market trends determined by the bond market, so I wouldn’t be surprised if we see another push higher into the first week of March. The aim for bulls is likely to be the 61.8% Fibonacci at 21.19, although some resistance has already been seen at the 200-SMA line (20.99).

To the downside, bearish pressure seems slightly limited at this point but we may see an attempt for new sellers to enter the market at more favorable levels. That said, I don’t think the current uptrend is in danger unless we see a drop below 20.50, and even then I expect to see support at the 76.4% Fibonacci (20.18) before any further downside is achieved.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin