US Dollar, Housing Data, Fed Policy– Talking Points

- The US Dollar could rise after housing data is released

- Greenback gains may be amplified by industrial reports

- Holiday-packed week likely to result in thinner liquidity

APAC Recap

The Australian and New Zealand Dollars rose after China announced that it will lower import tariffs for some US goods starting on January 1, 2020. This comes as Beijing and Washington continue to negotiate a trade agreement following the completion of phase 1. Looking ahead, the holiday-packed week means liquidity will be thinner than usual which opens the door to potentially violent volatility.

US Dollar Outlook

The US Dollar may rise if local housing data beats forecasts and upside potential may be magnified by the release of industrial statistics. Preliminary durable goods orders for November are expected to have grown to 1.5 percent, higher than the prior 0.5 percent figure. Since US-China trade tensions have somewhat eased, trades may start seeing marginal improvements in manufacturing reports.

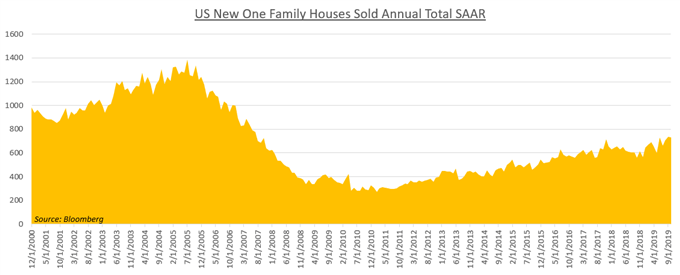

New home sales for November are expected to grow at a slightly slower pace with an estimate of a 730k print, three thousand less than the prior 733k report. Housing data may start getting softer since the Fed announced that it intends on holding rates unless economic conditions became materially worse or inflation remains persistently above the 2 percent target.

Therefore, since credit conditions are largely expected to remain unchanged – as opposed to earlier this year when rates were cut several times – borrowers may be less inclined to take on a mortgage. As a result, inflation may start to become more tepid. This is because when borrowers typically buy a house, it results in a multi-iterated spending spree as consumers purchase goods to fill their homes with which typically boosts price growth.

US DOLLAR TRADING RESOURCES

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter