TALKING POINTS – YEN, US DOLLAR, AUSSIE DOLLAR, OECD, BANK OF CANADA

- Yen, US Dollar rise as most G10 FX splits along risk on/off divide

- Aussie Dollar suffers outsized losses on GDP data, dovish Lowe

- OECD outlook update, BOC rate call may sustain defensive tone

Most currency market price action appeared to be divided along sentiment lines in Asia Pacific trade, even as regional stocks turned in a mixed performance. The anti-risk Japanese Yen and US Dollar traded broadly higher while the sentiment-geared Australian and New Zealand Dollars suffered outsized losses.

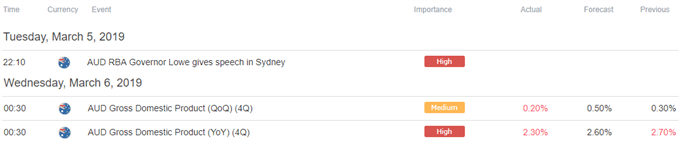

The Aussie was particularly weak in the wake of disappointing GDP data as well as pointedly dovish comments from RBA Governor Philip Lowe. He said it is “hard to see a scenario where rates rise this year,” adding that it is unlikely that inflation will be a problem any time soon.

The British Pound diverged from the risk on/off dynamic. It traded lower following a Reuters report saying that Brexit talks between EU and UK negotiators failed to reach a deal on Tuesday. Talks in Brussels are set to resume today.

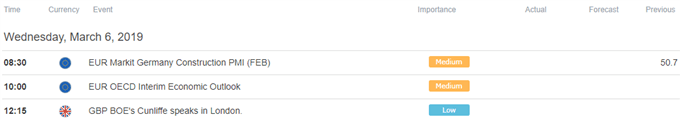

OECD OUTLOOK UPDATE, BOC RATE DECISION MAY SPOOK MARKETS

Looking ahead, an updated economic outlook from the OECD and a policy decision from the Bank of Canada are in focus. The former may echo recent downgrades from similar entities like the IMF and World Bank. The latter might take a similarly downbeat view, echoing recent weakness in local and US data flow.

Taken together, these might offer fresh fodder to building concerns about global economic slowdown, cooling risk appetite. In fact, bellwether S&P 500 are pointing tellingly lower, perhaps in anticipation of just such an outcome. If it materializes, APAC-session G10 FX price moves might find scope for follow-through.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter