TALKING POINTS – TRADE WAR, EMERGING MARKETS, FRANC, CANADIAN DOLLAR

- Trade war, emerging market worries continue to weigh on sentiment

- Canadian Dollar leads commodity FX drop, Franc gains outpace Yen

- Euro may shrug off CPI report as ECB policy remains on autopilot

Residual risk aversion continued to plague currency markets in Asia Pacific trade. Most regional shares declined as markets continued to fret about trade war escalation between the US and China as well as renewed jitters in emerging market assets.

US President Donald Trump threatened to hit world’s number-two economy with a further $200 billion in tariffs while alleging that Beijing is undermining North Korea denuclearization efforts. Meanwhile, turmoil in Argentina rekindled worries about the knock-on effects of Fed-driven rise in global borrowing costs.

Rotation at the risk on/off extremes of the G10 FX space saw the Canadian Dollar leading commodity bloc currencies lower after its Aussie and Kiwi cousins suffered outsized losses yesterday. On the anti-risk end of spectrum, the Swiss Franc similarly outpaced the Yen having lagged behind it in the prior session.

Looking ahead, sentiment trends seem likely to remain in focus. Futures tracking the FTSE 100 and S&P 500 are tellingly flat before London and New York come online, hinting that the bloodletting may ease a bit. With core issues unresolved, that may reflect concerns about weekend gap risk.

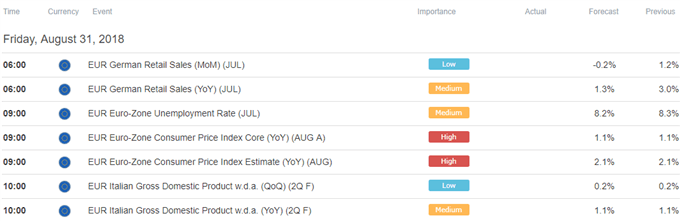

Eurozone CPI tops the data docket. The headline inflation rate is expected at 2.1 percent on-year in August, unchanged from the prior month. The Euro seems unlikely to celebrate even if recently upbeat data outcomes relative to forecasts prove to foreshadow an upside surprise as the ECB remains on autopilot.

See our study on the history of trade wars to learn how it might influence financial markets!

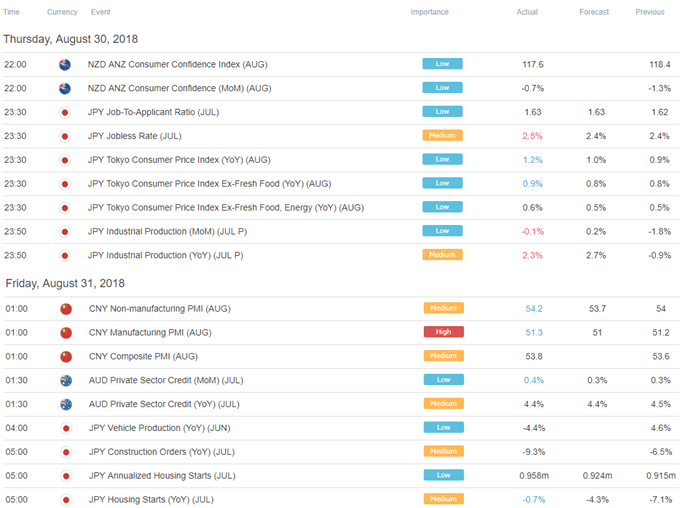

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter