Talking Points:

- Euro unlikely to find strength in GDP pickup as inflation stagnates

- US Dollar continues to gain as State of the Union speech approaches

- Yen up as APAC stocks decline, Pound stung by Brexit-related jitters

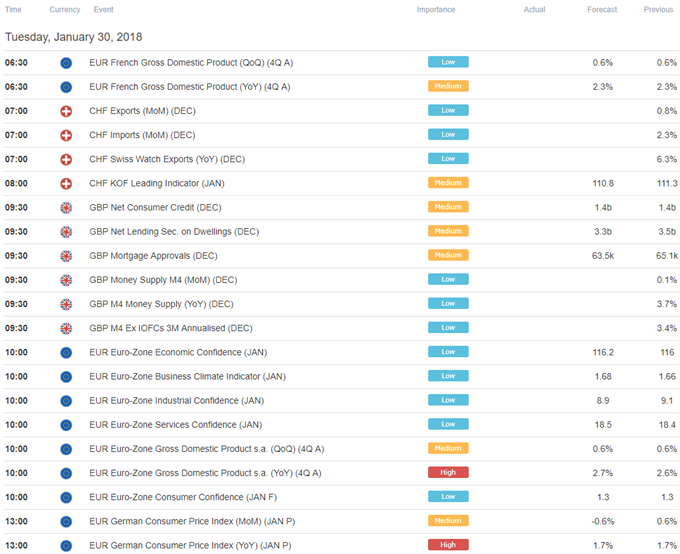

Eurozone GDP data headlines the data docket in European trading hours. The on-year growth rate is expected to edge up to 2.7 percent in the fourth quarter, the highest in almost seven years. A brisk pickup in performance last year nonetheless failed to push price growth toward the ECB’s target, a disappointment highlighted by the central bank’s President Mario Draghi just last week.

As if to make cement that point, German CPI figures are expected to show the headline year-on-year inflation rate remained at 1.7 percent in January, unchanged from the prior month and squarely in line with the average of last year’s choppy range. On balance, this suggests that – absent dramatically positive surprises – the Euro is unlikely to find lasting upside follow-through from the day’s releases.

The US Dollar continued to march higher in Asia Pacific trade, extending the prior session’s gains. The advance appear to reflect pre-positioning ahead of the upcoming State of the Union address from President Donald Trump. Speculation that he will unveil a large infrastructure-spending scheme have offered a boost to Fed rate hike bets, pulling the greenback upward by extension.

The Japanese Yen traded broadly higher as regional bourses followed Wall Street downward, boosting the perennially anti-risk currency. The British Pound continued to lose ground, extending yesterday’s Brexit-inspired losses. A verbal spat between the leading negotiators on both sides coupled with worries about the stability of the May government featured prominently in the newswires.

See our free guide to learn how you can use economic news in your FX trading strategy !

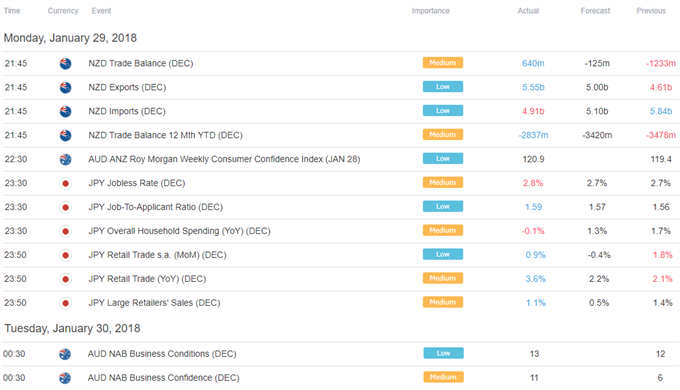

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak