- ISM Non-Manufacturing Survey to Increase to 54.8- Highest Since December 2015.

- Employment Component Rebounded Last Month After Showing a Contraction in February.

For more updates, sign up for David's e-mail distribution list.

Trading the News: ISM Non-Manufacturing

Another pickup in the ISM Non-Manufacturing survey may heighten the appeal of the greenback and spark a larger pullback in EUR/USD as it raises the outlook for growth and inflation.

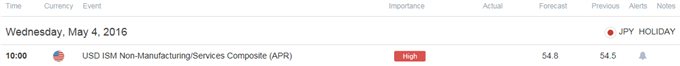

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Despite the ongoing 9 to1 split within the Federal Open Market Committee, Chair Janet Yellen and Co. may come under increased pressure to further normalize monetary policy at the next quarterly meeting June especially as the U.S. economy approaches ‘full-employment.’

Expectations: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Pending Home Sales (MoM) (MAR) | 0.5% | 1.4% |

| Existing Home Sales (MoM) (MAR) | 3.9% | 5.1% |

| Consumer Credit (FEB) | $14.900B | $17.217B |

The expansion in housing accompanied by the pickup in private-sector credit may boost service-based activity, and a positive development may generate a bullish reaction in the greenback as it boosts interest-rate expectations.

Risk: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Personal Spending (MAR) | 0.2% | 0.1% |

| Durable Goods Orders (MAR P) | 1.9% | 0.8% |

| Advance Retail Sales (MoM) (MAR) | 0.1% | -0.3% |

Nevertheless, the slowdown in household spending may largely weigh on economic activity, and an unexpected downtick in the ISM survey may weigh on the U.S. dollar as market participants push out bets for the next Fed rate-hike.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

How To Trade This Event Risk(Video)

Bullish USD Trade: ISM Non-Manufacturing Survey Climbs to 54.8 or Higher

- Need red, five-minute candle following the print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: Gauge for Service-Based Activity Disappoints

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The Release

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- EUR/USD may make a more meaningful run at the August high (1.1713) as it breaks out of the triangle/wedge formation in April, but the pair stands at risk for a near-term pullback as the Relative Strength Index (RSI) struggles to push above 70 and appears to be turning around ahead of overbought territory.

- Interim Resistance: 1.1760 (61.8% retracement) to 1.1810 (38.2% retracement)

- Interim Support: Interim Support: 1.0380 (78.6% expansion) to 1.0410 (61.8% expansion)

Impact that the ISM Non-Manufacturing survey has had on EUR/USD during the previous month

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| MAR P 2016 | 04/05/2015 14:00 GMT | 54.2 | 54.5 | +13 | +22 |

February 2016 ISM Non-Manufacturing

The ISM Non-Manufacturing survey beat market expectations in March, with the index advancing to 54.5 from 53.4 in February. A deeper look at the report showed the gauge for business activity advanced to 59.8 from 57.8 to mark the highest reading since October, while the Employment component climbed to 50.3 from 49.7 during the same period. Despite the better-than-expected reading, the initial downtick in EUR/USD was short-lived, with EUR/USD climbing back above the 1.1350 region to end the day at 1.1379.

Get our top trading opportunities of 2016 HERE

Read More:

SPX500 Technical Analysis: At Support, but Beware the Monthly Doji

China’s Market News: Earnings Reports Reveal Government Purchases

EUR/USD Testing Neckline of Major Double Bottom Pattern

USD/JPY Technical Analysis: Signs of Hope for JPY Bears?

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.