Talking Points:

- FOMC meets at 14:00 EST/19:00 GMT today - no change in policy expected as there aren't new economic projections.

- DXY Index has seen its technical structure erode considerably.

- Join me today at 13:45 EST/18:45 GMT in the DailyFX Live Trading Room for coverage of the February FOMC meeting.

The February FOMC meeting should more or less culminate in policymakers 'going through the motions' - huddling to discuss recent developments in the economy, with few substantive changes in outlook. The Federal Reserve will keep its main rate on hold at 0.50-0.75% (Fed funds futures pointing to a 14% chance of a hike - it should be 0%, in my opinion), citing further tightness in the labor market and signs that inflation should continue to push higher over the course of 2017.

As is typically the case at policy meetings in which no new economic projections are presented and Fed Chair Janet Yellen doesn't have a press conference, additional focus will be on the policy statement released at 19:00 GMT. Yet a lack of significant economic developments in recent weeks - US economic data has been middling (Q4'16 GDP was a mere +1.9%), while the Trump administration has seemingly pushed back expectations for fiscal stimulus - likely means thaht the Fed won't have the confidence to make that many significant changes to its outlook.

The key for the US Dollar today, however, is to what degree of confidence the FOMC has in the US economy, or simply, 'how quickly does the Fed think it will be able to raise rates next?'

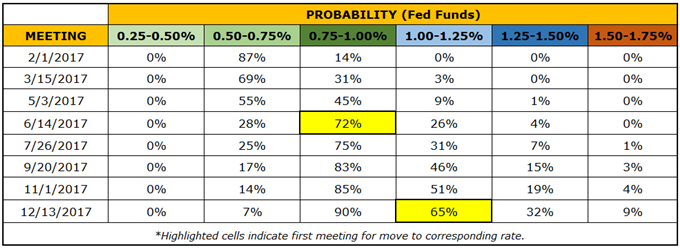

As witnessed since the US elections in November, markets have priced in June 2017 and December 2017 as when the Fed will raise rates next (table 1 below). The timing of these expected hikes isn't exactly surprising: at both the June and December meetings, the Fed will release new SEPs and Fed Chair Yellen will hold a press conference.

Table 1: Fed Rate Hike Expectations Through December 2017

See the above video for a discussion on why US yields have decoupled from the US Dollar, as well as for technical considerations and specific levels of importance in DXY Index, Gold, EUR/USD, GBP/USD, AUD/USD, USD/JPY, AUD/JPY, and NZD/JPY.

Read more: US Dollar (DXY) Hanging on by a Thread - What’s Next?

Webinar Schedule for Week of January 29 to February 3, 2017

Monday, 7:30 EST/12:30 GMT: FX Week Ahead: Strategy for Major Event Risk

Wednesday, 7:30 EST/12:30 GMT: Trading Q&A

Thursday, 7:30 EST/12:30 GMT: Central Bank Weekly

--- Written by Christopher Vecchio, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form