To receive Michael’s analysis directly via email, please SIGN UP HERE

- NZD/JPY Monthly opening-range taking shape just below key resistance

- Check out our 4Q projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

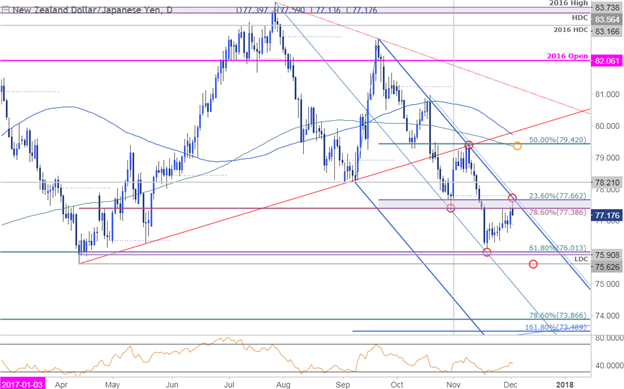

Technical Outlook: NZD/JPY has been trading within the confines a well-defined descending pitchfork formation extending off the yearly highs with prices trading into the 77.38/66 resistance zone today before turning lower. Notice the similarities in the previous failure patterns into this upper parallel – heading into the open in December, we’re looking for an exhaustion high while below this slope. Key support remains at 75.91-76.01 with a break below 75.63 needed to expose the next leg lower targeting 73.86 & 73.50.

New to Forex? Get started with this Free Beginners Guide

NZD/JPY 240min Chart

Notes: A closer look at price action highlights a near-term ascending channel formation extending off the November lows with channel resistance converging on the upper parallel (blue) over the next few days. Note that ongoing momentum divergence leaves the advance vulnerable here and while we cannot rule out another run at the highs, our focus is lower while below this threshold with a break below 76.84 shifting the focus back towards the 50-line / 61.8% retracement at 76.01.

Bottom line: looking for an exhaustion high early in the month while below 77.66/77 with a downside break of this near-term channel needed to kick things off. Note that it’s still early in the month and we’ll be looking for the December opening range to offer further clarity on our medium-term directional bias. A topside breach would invalidation our near-term outlook with such a scenario risking a rally back towards 78.18/21 and 78.63.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

---

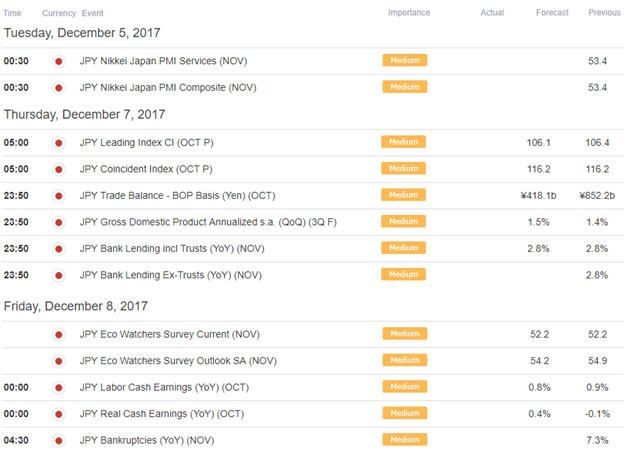

Relevant Data Releases

Why does the average trader lose? Avoid these Mistakes in your trading

Other Setups in Play

- Weekly Technical Outlook: Top December Setups on USD, EUR Crosses

- EUR/USD Price Analysis: Bullish Outlook Mired by Slope Resistance

- GBP/USD Breakout Faces First Hurdle- Bullish Above November Open

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com