Australian Dollar, AUD/USD, Iron Ore, China, PMI - Talking Points

- Australian Dollar falls against stronger Dollar, lower iron ore prices

- Chinese manufacturing PMI data eyed to gauge China’s economy

- AUD/USD nears trendline that may provide floor for a rebound

Thursday’s Asia-Pacific Outlook

The Australian Dollar surrendered to a broadly stronger US Dollar overnight after stocks closed mixed in New York. Federal Reserve Chair Jerome Powell, speaking from a central banker forum in Portugal, cast doubt over the economy returning to its pre-Covid normalcy, stating, “What we don’t know is whether we’ll be going back to something that looks like, or a little bit like, what we had before.” European Central Bank President Christine Lagarde was more confident in that assessment stating, “I don’t think we’re going back. . .”

The overall signal sent by the central bankers indicated that they are willing to sacrifice economic growth if it means tamping down on inflation. Market-based inflation gauges, such as breakeven rates, plummeted overnight. The US 2-year breakeven rate—a proxy for inflation two years out—fell to its lowest level since February 11 at 3.45%. That weighed on gold prices, with XAU falling for a third session.

A sharp drop in iron ore prices in China is a concerning headwind for the Aussie Dollar, although prices have only shown a modest reaction given the nearly 5% drop over the past 24 hours. The move is somewhat surprising amid easing restrictions in China. One concern is that imports will likely lag behind levels seen earlier this year as policymakers appear to favor a slow and steady approach to providing stimulus.

However, economic data from China may provide a reprieve to prices. China’s National Bureau of Statistics (NBS) is set to report its purchasing managers’ index (PMI) at 01:30 GMT. Analysts expect the figure to cross the wires at 50.5, which would bring the index out of contraction and into expansion. A better-than-expected print may see iron ore and the Australian Dollar move higher.

Notable Events for June 30:

- New Zealand - ANZ Business Confidence (JUN)

- Philippines – Producer Price Index (MAY)

- Australia – Private Sector Credit (MAY)

- Japan – Housing Starts (MAY)

Click here to view today’s full economic calendar

AUD/USD Technical Forecast

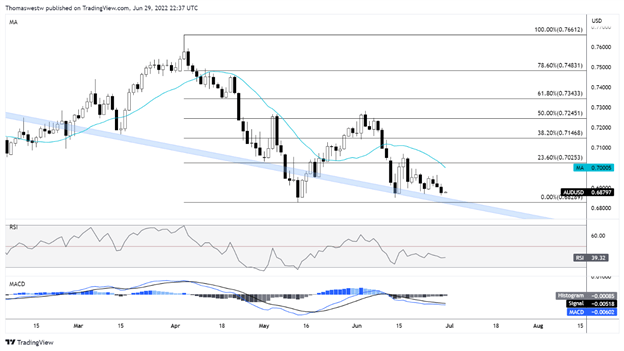

AUD/USD trailed lower overnight, recording a third daily loss, and putting prices near a trendline from the October 2021 swing high. That trendline may provide support for a potential rebound. If so, the falling 20-day Simple Moving Average (SMA) comes into play as potential resistance. Meanwhile, the MACD oscillator looks to be gearing up for a cross above its signal line.

AUD/USD Daily Chart

Chart created with TradingView

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter