Australian Dollar, AUD/USD, China, Trade, RBA, Omicron - Talking Points

- Australian Dollar rises versus USD as broader risk aversion recedes

- Chinese trade data, Reserve Bank of Australia meeting in focus

- AUD/USD rises, with potential test of former 2021 low coming

Tuesday’s Asia-Pacific Forecast

The risk-sensitive Australian Dollar gained versus the US Dollar overnight as investors fear over the Omicron variant settled down. Scientists are not seeing signs that the new variant is more deadly and President Biden’s chief medical adviser, Dr. Anthony Fauci, said Monday that Omicron doesn’t appear to have a great degree of severity. The Dow Jones Industrial Average (DJIA) gained 1.87% on Wall Street.

Today, focus will turn to the Reserve Bank of Australia’s (RBA) interest rate decision today, due out at 03:30 GMT. The central bank is widely expected to keep rates on hold in its last meeting of the year. Markets are pricing in an RBA rate hike next year, but RBA chief Lowe has held to a 2024 timeline. A hawkish shift from Mr. Lowe may see the Australian Dollar gain in response.

Crude and Brent oil prices rose sharply overnight as Omicron worries receded. OPEC and its allies, known as OPEC+, agreed to push forward with a 400k barrels per day increase in January but stands ready to adjust quickly if needed. That may put an artificial floor under prices if markets believe the group is ready to pull back any supply adjustments if demand ebbs. Traders will be watching inventory data later this week from the API and EIA.

China’s November trade balance is set to cross shortly before the RBA decision. Analysts expect the country’s trade surplus to fall to $82.75 billion from $84.54 billion. China’s central bank moved to boost liquidity earlier this week by reducing the reserve requirement ratio for banks. The move will inject nearly $200 billion into China’s market. The Australian Dollar may rise against the Greenback if China’s trade surplus impresses today.

AUD/USD Technical Forecast

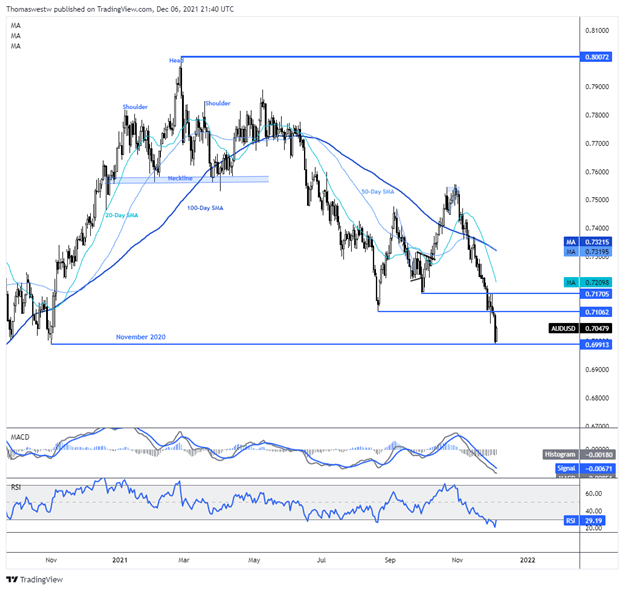

AUD/USD looks poised to continue its overnight move higher. The former 2021 low at 0.7106 may serve as resistance to the upside. Alternatively, a move lower may see the November 2020 low tested at 0.6991. The Relative Strength Index (RSI) is making a return from oversold conditions, currently just below the 30 mark.

AUD/USD Daily Chart

Chart created with TradingView

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter