Australian Dollar, AUD/USD, Covid, Japan, COT - Talking Points

- Australian Dollar prepares for Reserve Bank of Australia rate decision

- Covid cases hit record high in Australia as NSW drive bulk of infections

- AUD/USD at multi-month highs but prices may be ripe for a pullback

Monday’s Asia-Pacific Outlook

The Asia Pacific session may see a relatively quiet open today as traders prepare for central bank rate decisions following a solid showing for risk assets last week. The Reserve Bank of Australia (RBA) will release its September interest rate decision on Tuesday. Economists are mixed on whether the RBA will suspend its plan to begin tapering asset purchases. Such a move would likely bode well for Australian stocks but it may pressure AUD.

Victoria and New South Wales (NSW) remain under lockdowns as Covid cases continue to rise. The highly transmissible Delta strain has pushed daily new cases to record highs. Australia reported 1,684 new Covid cases this Sunday, with 1,485 of those from NSW. Policy makers are quickly securing vaccines to boost their efforts to achieve a 70% vaccination rate. That is when health policy experts agree that widespread lockdowns can be rolled back. Some analysts believe a recession is looming in Q3 given the economic damage that restriction measures have already done.

Elsewhere, Japanese stocks may continue outperforming. Japan’s Nikkei 225 index put in a huge 5.38% gain last week. Prime Minister Yoshihide Suga’s resignation announcement predicated the rally in Japanese equities. Analysts believe Suga’s successor will take a more aggressive approach in battling the Covid pandemic.

Today’s economic calendar is rather sparse, with Australia set to see Ai Group Services Index data for August cross the wires. Household spending data out of Japan for July will also hit the newswires. Later this week China may provide more risk-event potential, with the economic powerhouse’s August trade balance and inflation data on the economic calendar for Tuesday and Wednesday respectively. US markets are closed Monday, which may translate to less liquidity in today’s APAC session.

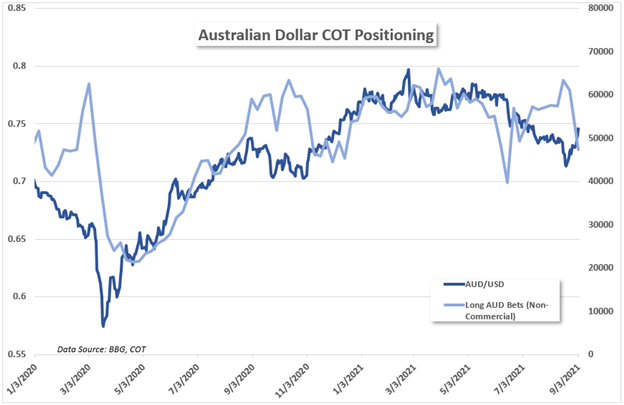

Australian Dollar – COT Positioning

The Australian Dollar is looking to make a third weekly advance against the US Dollar. The latest Commitments of Traders data (COT) from the CFTC shows long bets dropped last week for non-commercial traders (which represent large speculators in the market). Short bets decreased too, however. Still, long AUD bets remain well off 2020 lows. The data may suggest that traders are taking profits off while still having some confidence that the Australia Dollar may strengthen. Some deleveraging going into the RBA decision may also explain the data.

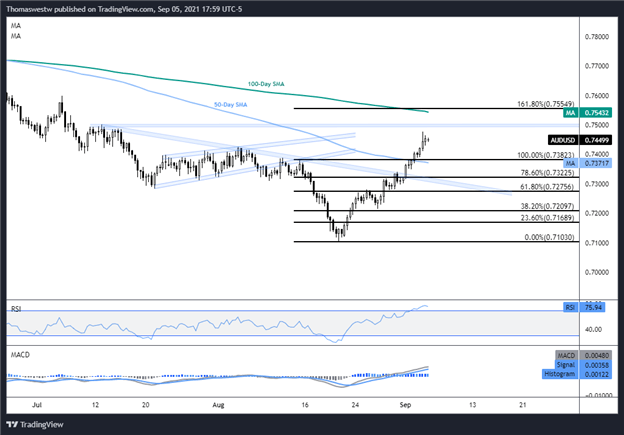

AUD/USD Technical Outlook:

AUD/USD’s multi-week rally has brought the currency pair to the highest level since mid-July. Prices breached the falling 50-day Simple Moving Average (SMA) last week. A level of prior resistance from July may cap prices near the psychological 0.7500 level. A break higher would see the 100-day SMA and 161.8% Fibonacci extension shift into focus.

Alternatively, a break lower would see prices move back toward the 50-day SMA. Below that and a prior descending trendline would be on the plate. The current move may be overdone and ripe for a pullback, according to the Relative Strength Index (RSI). Typically, an RSI reading of over 70 hints that prices may be overbought. RSI is currently near the 76 mark on the 8-hour chart.

AUD/USDEight-Hour Chart

Chart created with TradingView

Australian Dollar TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter