Wednesday’s Asia-Pacific Outlook

- Australian Dollar gains versus US Dollar ahead of Australian Q2 GDP

- NZD sees broad-based strength after New Zealand Covid cases drop

- AUD/USD ends August with a loss as a trendline caps upside overnight

Wednesday’s Asia-Pacific Outlook

The Australian Dollar gained versus the US Dollar overnight as Wall Street stock indexes shifted lower to close out August. Major US equity indexes closed higher for the month despite Tuesday’s selloff. The United States saw a drop in consumer confidence in August, with the Conference Board’s index sinking to 113.8. That marks a six-month low. Rising prices and the Delta variant weighed on the figure.

Australia’s second-quarter gross domestic product will provide today’s key event risk. Analysts expect the figure to cross the wires at 0.4% on a quarter-over-quarter basis, according to a Bloomberg survey. That would mark the country’s fourth quarter of slowing growth. Moreover, a series of prolonged lockdowns across New South Wales (NSW) and Victoria have put a possible economic contraction on the cards for Q3.

Elsewhere, crude oil saw its worst monthly performance of the year as traders eye warning signs that consumption in the global economy may be leveling off. An EU Council statement urging EU membernations to halt non-essential travel from the United States was released on Monday. It is the latest warning shot for the travel and tourism industries. US traveler throughput dropped to 1.623 million on Monday, according to TSA data. That is down 28.47% from 2019.

The New Zealand Dollar performed well overnight after the island nation reported the third day of declines in Covid-19 case numbers. The encouraging data suggests that containment measures are effective, which contrasts with what has been seen in neighboring Australia. A level 4 lockdown will continue for Auckland, but other regions are expected to seedowngrades to level 3 later today. The upbeat Kiwi Dollar comes despite the weakest ANZ business confidence print since March. AUD/NZD finished August nearly 1.5% lower.

AUD/USD Technical Outlook:

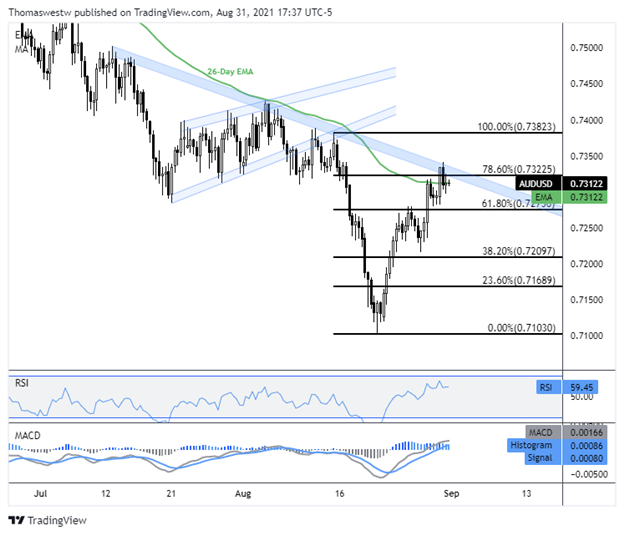

AUD/USD ended August with a 0.41% loss. The currency pair failed to eclipse a descending trendline overnight and is currently trading around the 26-day Exponential Moving Average (EMA). The MACD oscillator is weakening, indicated by the falling histogram reading. The 61.8% Fibonacci retracement may provide support to the downside. Alternatively, the descending trendline will likely continue to cap upside.

AUD/USD Eight-Hour Chart

Chart created with TradingView

Australian Dollar TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter