Australian Dollar, AUD/USD, Export Prices, Covid Talking Points

- The Australian Dollar is up versus the US Dollar after Wednesday’s FOMC

- Australian export and import prices on tap for key event risk today

- AUD/USD looks for direction after forming base through last week.

Thursday’s Asia-Pacific Outlook

Asia Pacific markets look set for a possible risk-on session after US stocks closed mostly higher. The Federal Reserve decision on Wednesday pushed longer-dated Treasuries lower, with the benchmark 10-year yield dropping over half a percent. The safe-haven US Dollar weakened against some of its major peers, including the risk-sensitive Australian Dollar, as well as the commodity-linked Canadian Dollar.

The Australian Dollar remained in a slightly stronger position versus the US Dollar, but the currency pair remains on track to record its second month of losses as July comes to a close. A higher-than-expected CPI print out of Australia on Wednesday helped underpin prices, but a wave of lockdowns throughout the country weighed on sentiment. Sydney, the capital city of New South Wales, will remain in a lockdown.

Today’s ANZ business confidence out of New Zealand may spur some event risk in the region. The New Zealand Dollar has fared much better against the Greenback than the Aussie Dollar, but NZD/USD is also tracking a monthly loss. Export and import prices out of Australia for the second quarter will follow shortly after. Iron ore prices continued to rise through Q2, which is likely to help Australia’s export prices.

The Australian states of Victoria and South Australia exit lockdowns today after weeks of increased restrictions to contain Covid outbreaks. However, future snap lockdowns may be likely until much higher vaccination rates are in place. Currently, only 13.6% of the population is fully vaccinated. That is well below other developed countries, like the United States.

AUD/USD Technical Outlook:

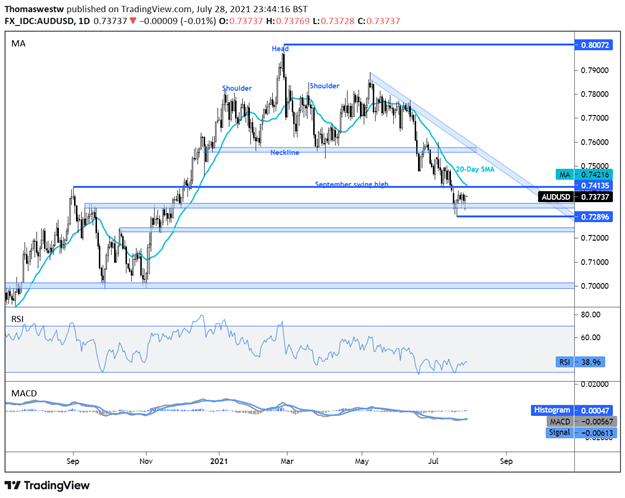

The Australian Dollar has been in a short phase of consolidation versus the US Dollar since rebounding from a 2021 low last week. Climbing above the September swing high at 0.7413 may open the door to some follow-through. Alternatively, dropping below a base of support near 0.7356 may see prices head back toward the 2021 low at 0.7289. MACD is turning higher, which may indicate some upward energy is forming.

AUD/USD Daily Chart

Chart created with TradingView

Australian Dollar TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter