Japanese Yen, USD/JPY, Covid, Market Sentiment -Talking Points

- Asia-Pacific stocks may be set for a neutral open as traders assess ongoing risks

- India’s alarming rise in Covid cases may begin dragging on sentiment in the near term

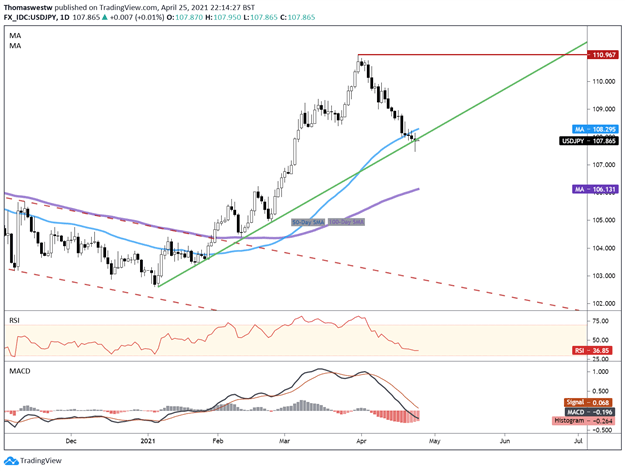

- USD/JPY testing trendline support following a third weekly price loss

Monday’s Asia-Pacific Outlook

Asia-Pacific markets may open the week on a neutral note as traders grapple with conflicting fundamental drivers. Two major headwinds for the market are an alarming increase in Covid cases through developing and emerging markets, and the other is a proposed raise on the capital gains tax rate in the United States by the Biden administration. Contrarily, earnings – in the US and elsewhere – have been generally positive, helping to underpin sentiment to a degree.

India is seeing a massive second wave of Covid, with the country’s caseload making up nearly half of all new daily cases. According to Johns Hopkins University, the death count is rapidly approaching the 200,000 mark. Still, many experts believe the true count may be much higher, and worse yet, a variant of Covid labeled as a “double mutant” is thought to be more contagious. While the situation in India hasn’t seeped into broader market sentiment, it is wise to keep an eye on the situation.

Monday is void of high-impact economic events, but Japan will release its final coincident indicator Index reading, and South Korea will publish figures for Gross Domestic Product (GDP) for the 4Q. The consensus estimate stands at 1.1% on a year-over-year basis, up from the prior read of -1.2%. South Korea’s government has handled the country’s Covid situation exceptionally well and signed a contract with Pfizer over the weekend for the purchases of 40 million Covid doses, according to Reuters.

Meanwhile, Japan has declared another state of emergency as Covid cases and hospitalizations rapidly increase. The government initiated emergency measures aimed at reducing the spread but falls short of a complete lockdown. The Yen has performed well throughout April, with USD/JPY aiming for a fourth weekly loss. Yen traders and central bank watchers will have their eye on the Bank of Japan’s (BoJ) interest rate decision and quarterly outlook report set to cross the wires Tuesday morning.

USD/JPY Daily Chart

The Japanese Yen strengthened against the US Dollar last week, bringing USD/JPY to an ascending trendline formed off the January swing low. A break below support would likely see the currency pair fall further, perhaps to the 100-day Simple Moving Average (SMA). Should support hold, however, a bounce higher to retake the 50-day SMA and subsequently test the March multi-month swing high at 110.96 may be on the cards.

USD/JPY Daily Chart

Chart created with TradingView

USD/JPY TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter