Wall Street, AUD/USD, Lunar New Year, RBA – Talking Points

- Wall Street sees mixed trading as investors assess the economic recovery

- Light volume and economic prints ahead as Lunar New Year holiday kicks off

- AUD/USD is aiming higher despite dovish comments from RBA board member

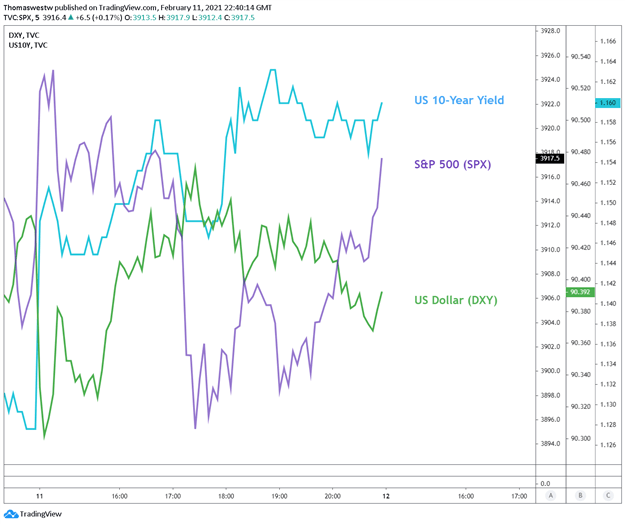

Wall Street saw a mixed trading day on Thursday after initial jobless claims data revealed the US labor market continues to struggle despite recent improvements seen in Covid case figures across the country. The tech-heavy Nasdaq Composite gained 0.38% while the S&P 500 and Dow Jones Industrial Average traded nearly flat, closing at +0.17% and -0.02%, respectively.

Markets are taking a step back after a strong start to the month as investors evaluate economic conditions and the broader recovery amid the ongoing pandemic. Initial jobless claims for the week ending February 6 crossed the wires at 793k, slightly above the forecasted 757k figure, according to the DailyFX Economic Calendar. While the recovery in the US labor market is less than stellar, the four-week average continues to see marginal improvements as vaccination rates increase.

Elsewhere, the US Dollar weakened further as the DXY index dropped below 90.4. Treasuries also moved lower, particularly long-dated tenures. These pushed yields higher and steepened the curve after Chair Jerome Powell reinforced the Fed’s stance to remain in an accommodative posture until the labor market sees substantial improvements.

S&P 500, US Dollar, 10-Year Treasury Yield 5-Minute Chart

Chart created with TradingView

Friday’s Asia-Pacific Outlook

Equity markets in China and Hong Kong will remain closed into next week due to the Lunar New Year holiday. This may also translate into lower volumes in the foreign exchange markets as traders throughout China, Japan, South Korea, and elsewhere ring in the Year of the Ox. Hong Kong’s Hang Seng index (HSI) finished near multi-month highs at the close of a shortened trading session on Thursday.

The holiday break also translates into a lighter economic calendar for the week ahead. Still, Friday will see India release inflation data for January along with manufacturing and industrial production figures for December. The Indian Rupee may continue to strengthen against the Greenback, but a softer CPI print could inspire RBI rate cut bets, cushioning USD/INR’s descent.

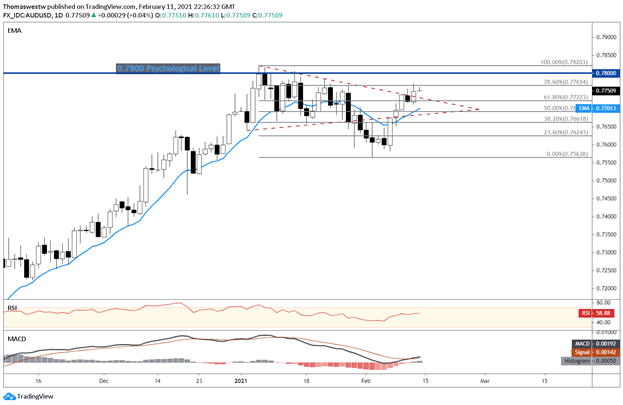

Meanwhile, the Australian Dollar is seeing broad-based strength, with AUD/USD and AUD/NZD trading back near multi-week highs. Aussie-Dollar strength follows dovish comments from RBA board member Ian Harper, who told Bloomberg that “the bank can continue to buy bonds for as long as it likes, there’s no obstacle to that,” suggesting that the central bank’s policy on quantitative easing may possibly be extended further out, if necessary. Despite this, the Aussie may have been focusing on risk trends and capitalizing on a weaker Greenback.

AUD/USD Technical Outlook

AUD/USD’s recent strength has seen prices pierce through a previously formed Symmetrical Triangle pattern after a bearish selloff formed after prices broke below that triangle’s lower bound. Now, the pair is approaching its January multi-year high. The 78.6% Fibonacci retracement from the January – February move appears to offer the most immediate overhead obstacle.

Momentum appears poised to guide prices higher in the near-term, with the MACD line making a bullish cross above its signal line. If prices manage to climb over the 78.6% Fib level, the 0.7800 psychological level will move into focus before attempting to take out recent highs. To the downside, the 61.8% Fib level along with the triangle’s upper bound may offer support.

AUD/USD Daily Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter