US DOLLAR, TRUMP, BIDEN, US ELECTION, FEDERAL RESERVE - TALKING POINTS:

- US Dollar down in risk-on trade as markets position for Biden election win

- Hands-off FOMC posture, divided government may begin to sour sentiment

- Unexpected Trump win may spark broad-based liquidation across markets

The US Dollar tracked broadly lower yesterday as risk appetite firmed across global financial markets. The chipper mood seems to reflect easing worries about the outcome of the US presidential election. While a winner is yet to be officially declared as votes continue to be counted, data from betting markets hints that the likelihood of a victory for former Vice President Biden has solidified in the minds of investors.

That this is buoying sentiment seems to in part reflect relief at the likely confirmation of the markets’ baseline forecasts ahead of the vote. The polling data had traders pricing in a Biden victory. At the policy level, it is probably helpful for investors’ mood that the would-be incoming administration is expected to take a more conciliatory stance on trade relations. Trade wars have weighed on growth since 2018.

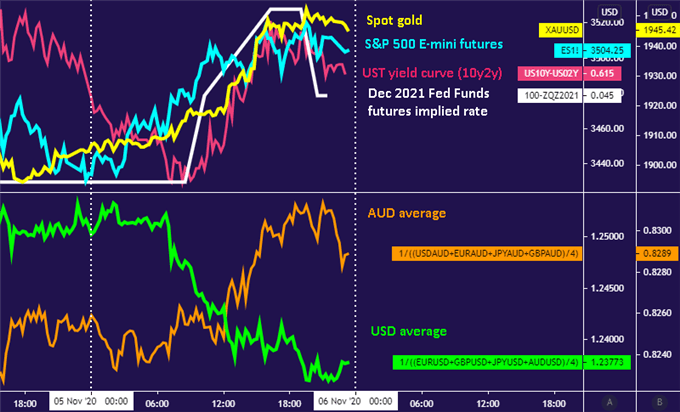

Within this context, the Greenback’s weakness seems to reflect ebbing safety demand for the go-to liquidity haven. The decline tellingly tracked inversely of a rise in the bellwether S&P 500 stock index and the sentiment-sensitive Australian Dollar. Gold prices likewise advanced as the Dollar’s retreat bolstered the appeal of anti-fiat alternatives.

Chart created with TradingView

US DOLLAR MAY RISE AS ELECTION RESULTS SOLIDIFY

Critically, the yield curve steepened and the outlook for US monetary policy embedded in Fed Funds futures moved to a less-dovish setting as sentiment improved. This seems to bolster the growth-positive narrative that traders are extrapolating from election results so far. An FOMC policy announcement that seemed to reiterate the central bank’s hands-off posture in place since August probably helped.

This may well set the stage for a USD recovery. Putting aside the question of who will be the next President of the United States temporarily, it can be said with relative confidence that the world’s largest economy will be steered by a divided government for at least the next two years. That seems to reduce scope for big-splash fiscal stimulus even as the Fed hits that it’s not able to deliver what is needed: demand replacement.

Put simply, the Fed has unambiguously asserted that while it can encourage recovery by ensuring the smooth functioning of lending markets and the abundant availability of credit, it cannot create economic activity itself. To the extent that this is what is required, the Chair Powell and company seem to be casting a hopeful eye to fiscal authorities rather than conjure up ways to bear more of the burden.

With this in mind, the upswing in sentiment may prove fleeting. The broader risk-on mood may fizzle once Mr Biden is broadly declared the winner as markets begin to consider next steps. That may revive haven Dollar buying. If Mr Trump improbably manages a narrow win, a wave of repositioning will probably amplify any push toward liquidation and lift USD further.

US DOLLAR TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter