Australian Dollar, RBA, US-China Tension, Coronavirus – TALKING POINTS

- Equity markets edged higher despite a surge in mortgage delinquencies

- Australian Dollar eyes RBA meeting minutes, US-China political risks

- AUD/NZD bullish streak may be amplified if the pair cracks key resistance

On balance, Wall Street trade ended on an upbeat note with the S&P 500 and Nasdaq indices closing 0.27 and 1.00 percent higher, respectively. The industrial-leaning Dow Jones index struggled, and closed 0.31 percent lower. In the latter benchmark, the “Consumer Finance” sub-classification led the way in losses. Specifically American Express (AXP) was down almost three percent.

Foreign exchange markets reflected an underlying buoyant optimism with the Australian and New Zealand Dollars crowned as the session’s champions. The haven-linked US Dollar underperformed, but the anti-risk Japanese Yen was trading higher. The exact force behind these particular market dynamics was unclear.

Delayed US-China trade talks and a gridlock in Washington over another coronavirus relief bill did not appear to dent sentiment. Market mood did briefly turn sour after mortgage delinquency rates for Q2 spiked to their highest level since 2011. However, risk appetite was robust enough to shrug at this statistic and continued to push equity markets higher.

Tuesday’s Asia-Pacific Trading Session

The Australian Dollar will be thrust into the spotlight ahead of the RBA meeting minutes amid the geopolitical backdrop of escalating US-China tensions. Not only were trade talks delayed but a US-led, multi-billion dollar arms sale to Taiwan has added another layer of friction between Beijing and Washington.

While this may instill a risk-off tilt in market mood, the jubilance on Wall Street may yet echo into Asia and could help offset losses in cycle-sensitive assets like AUD. The US Dollar may therefore extend its losses if the prevailing market environment prioritizes returns over liquidity.

For an in-depth look at geopolitical risks impacting markets, be sure to follow me on Twitter @ZabelinDimitri for updates.

AUD/NZD Analysis

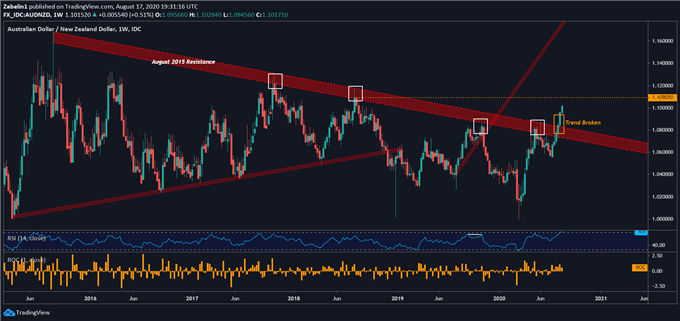

AUD/NZD continues to surge after breaking above five-year descending resistance. Prior to the break, the pair had retreated on average a little over six percent after every rejection. If buying pressure remains robust, AUD/NZD may challenge two-year resistance at 1.1090.

AUD/NZD – Daily Chart

AUD/NZD chart created using TradingView

How the pair proceeds from there will be critical. Puncturing that ceiling with follow-through could inspire additional buyers to enter the market if it suggests the pair’s winning streak has not concluded. Conversely, pulling back from it may precede a cooling-off period as traders re-evaluate the pair’s current position and its upside potential.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter