New Zealand Dollar, NZD/USD Forecast, Coronavirus, Equity Markets – TALKING POINTS

- Equity markets pulled back with information technology stocks and benchmarks leading losses

- Gradual reopening put a discount on digital services which thrived in lockdown environment

- NZD/USD broke a steep uptrend, potentially setting up a retreat – will the RBNZ derail that?

Wall Street ended on a gloomy note with the Dow Jones, S&P 500 and Nasdaq indices closing 0.38, 0.80 and 1.69 percent lower, respectively. The information technology subcategories in the former two benchmarks significantly contributed to losses in equity markets in addition to utilities. Not surprisingly, the tech-leaning Nasdaq took the hardest hit – why are technology stocks pulling back?

Despite a rising number of coronavirus cases, a general easing of lockdown measures and has helped push lockdown-sensitive stocks like Norwegian Cruise Line and Wynn Resorts higher. Technology stocks generally benefited from shelter-in-place and work-from-home policies because of the rise in demand for digital services. With gradual re-openings, tech stocks may retreat if priorities go from indoor to outdoor activities.

Amid the decline in equity benchmarks, the US Dollar rose as its haven appeal was briefly revived. Depite the downturn in market mood, the anti-risk Japanese Yen and similarly-behaving and Swiss Franc were some of the session’s biggest losers. The British Pound also weakened. The petroleum-linked Norwegian Krone and Canadian Dollar were crowned champions despite Brent crude oil prices suffering an over-one percent decline.

Wednesday’s Asia-Pacific Trading Session

Technology stocks may extend their selloff in Asia-Pacific trade, perhaps dragging gold prices and other dollar-denominated commodities down if haven-demand pushes the Greenback higher. NZD will be thrust into the spotlight ahead of the Reserve Bank of New Zealand (RBNZ) rate decision. Traders are anticipating for officials to not change the benchmark interest rate, currently set at 0.25%.

Having said that, implied volatility as of August 11 shows the New Zealand Dollar with the highest expectations among its G10 counterparts with a reading of 11.80. Local economic data has performed better-than-expected as of late, which could give the central bank impetus to hold fire on additional stimulus. If the RBNZ holds rates and does not alter the size of its $NZ60 billion QE ceiling, NZD may rally.

NZD/USD Analysis

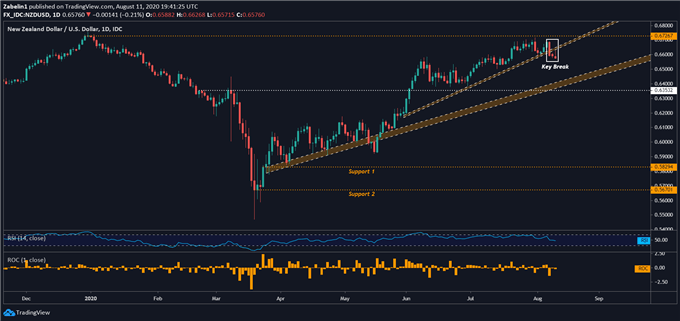

Since March, NZD/USD has been climbing, with steeper support established in late-May. However, the invalidation of the latter’s slope of appreciation under the January swing-high at 0.6726 opens the door to retesting the less-steep rising floor from earlier this year. Breaking below that could mark a tectonic shift in the pair’s trajectory, potentially leading to amplified losses if bearish momentum picks up steam.

NZD/USD – Daily Chart

NZD/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri or Twitter