Australian Dollar, Coronavirus, Asia-Pacific Stock Markets – TALKING POINTS

- Australian Dollar could fall with Asia-pacific stock markets as virus cases grow

- Credit spreads on corporate debt could rise and further magnify risk aversion

- AUD/USD ripe for downside breakout after failing to clear key resistance point

Wall Street ended on a downbeat note on Friday’s close with the Dow Jones, S&P 500 and Nasdaq indices closing 2.84, 2.42 and 2.59 percent lower, respectively. Hard and soft commodities along with cycle-sensitive currencies like the Australian and New Zealand Dollars suffered while the anti-risk Japanese Yen and US Dollar rose on market-wide risk aversion.

Treasuries across a range of maturities also gained along with spreads of credit default swaps (CDS) on investment-grade corporate debt. The source of risk aversion came from concern of the rising number of Covid-19 cases and what that could mean for future growth prospects that are already foreboding. Growing EU-US geopolitical tensions did not help lighten the mood.

Monday’s Asia-Pacific Trading Session

The cycle-sensitive Australian and New Zealand Dollars may suffer with US equity futures and Asia-Pacific stock markets as part of a broader risk-off tilt echoing from last week’s close. A relatively sparse data docket leaves traders more focused macro-fundamental themes like Covid-19 and the alarming medical metrics pertaining to the virus’ spread. Regional credit markets may be rattled and may amplify JPY and USD’s gains.

AUD/USD Technical Analysis

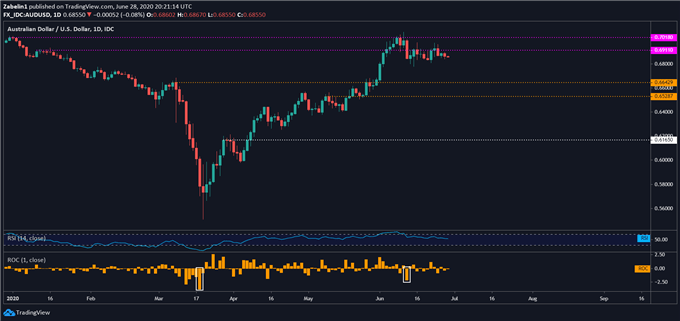

Ater failing to clear 0.7019 and 0.6911, bearish momentum in AUD/USD may be gaining traction after stalling at those levels signalled a lack of confidence in the pair’s upside potential – at least in the short term. As noted in prior pieces, AUD/USD may challenge a familiar inflection point at 0.6642, which if cleared could give way to further losses if it inspires additional sellers to enter the market.

AUD/USD – Daily Chart

AUD/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter