Australian Dollar, US Dollar, Asia-Pacific Stock Markets, AUD/USD, SPX – TALKING POINTS

- Australian Dollar, Asia-Pacific stocks may fall on geopolitical strains, rising Covid-19 cases

- EU-US trade tensions, widening regional credit spreads likely to amplify reginal stock losses

- AUD/USD’s solid rejection at key resistance may signal the beginning of a broader pullback

Wall Street ended the day on a downbeat note after a slew of sentiment-souring factors blew a chilling, bearish wind across markets. The S&P 500 and Nasdaq indices closed 2.5. and 2.19 percent lower, respectively, with the industrial-leaning Dow Jones index taking the biggest hit at 2.72 Percent. Crude oil prices suffered their worst one-day decline since June 11 and may have contributed to dragging down the petroleum-linked NOK.

The cycle-sensitive New Zealand, Australian and Canadian Dollars closed in the red, while the anti-risk US Dollar, Swiss Franc and Japanese Yen grazed on green pastures. CAD’s decline was exacerbated after Fitch Ratings downgraded Canada’s credit rating to AA+ with a stable outlook. The demotion came from concern of a deterioration in the state’s public finances in light of the extraordinary measures taken to combat Covid-19.

The source of the risk-off tilt in market mood appeared to have in part come from fear about a second spike in coronavirus infections as certain areas in the US continue to rise at alarming rates – particularly Texas. The other element of risk aversion came amid news of renewed cross-Atlantic trade tension between the US and EU. The White House is weighing imposing new tariffs on $3.1 billion of exports from key EU countries.

For two economic powerhouses to enter a trade war at an already-fragile time could rattle the sensitive confidence investors have been exuding – as reflected in elevated asset prices. In a state of increased geopolitical tensions, clouded by the storm clouds of weaker global trade, the anti-risk US Dollar and Japanese Yen may rise against their growth-sensitive peers like AUD and NZD.

Thursday’s Asia-Pacific Trading Session

The gloomy mood during Wall Street trade will likely spill over into and echo the same dynamics markets in Asia. JPY and USD may rise at the expense of regional emerging market FX, APAC stocks, and commodity-linked currencies like AUD and NZD. Credit spreads on corporate debt in Asia will also likely widen and further dampen sentiment and amplify risk-off market dynamics.

AUD/USD Analysis

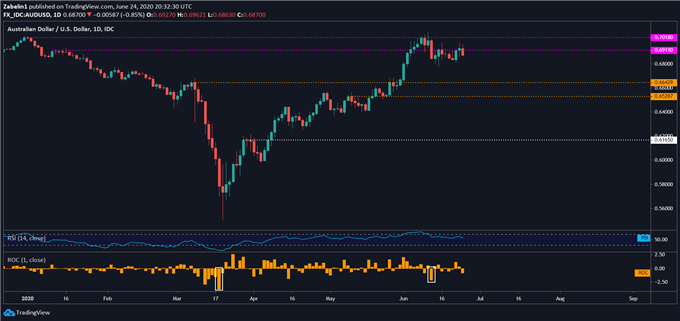

AUD/USD suffered its biggest one-day decline since June 11, the same day a wide-array of risk-oriented assets experienced their worst fall since the selloff in March. The pair’s capitulation below 0.6911 could reinforce growing fear that AUD/USD has capped – especially after failing to clear 0.7018 – which could lead an aggressive decline. In this scenario, selling pressure may experience a brief moment of respite at 0.6642.

AUD/USD – Daily Chart

AUD/USD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter