Gold, XAU/USD, US Dollar, Crude Oil, Fed, OPEC – Asia Pacific Market Open

- Gold prices soar as US Dollar and government bond yields tumbled

- XAU/USD vulnerable to reversal, crude oil prices looked past OPEC

- Markets brushed aside ever-dismal US data for more Fed stimulus

Gold Prices Soar on More Fed Stimulus as Crude Oil Prices Look Past OPEC+

Gold prices rallied on Thursday despite a rather rosy session on Wall Street. The Dow Jones and S&P 500 closed +1.22% and +1.45% respectively to wrap up the holiday-shortened week. This is despite the ongoing onslaught of dismal US economic data that is being plagued by the coronavirus outbreak. Jobless claims surged 6.6 million last week, well above the 5.5m estimate and slightly lower than the previous 6.8m gain.

Meanwhile University of Michigan Sentiment printed 71.0 in April, down from 89.1 prior. The velocity of the drop off was the worst on record as it reached the lowest since 2011. What drove focus away from the harsh economic reality was arguably further supportive measures from the Federal Reserve. The central bank announced a whopping $2.3 trillion loan program and this is on top of its “open-ended” QE plan.

The haven-linked US Dollar tumbled alongside front-end government bond yields, boosting anti-fiat gold prices. Meanwhile crude oil prices were unable to capitalize on a deal between OPEC+ members to reduce output by 10 million barrels per day. The markets may have viewed their efforts as insufficient to offset the anticipated hit to demand, equating into a buy the rumor and sell the facts situation.

Members said that they wanted G-20 nations to contribute reducing production by an additional 5m b/d. Mexico walked away from the meeting altogether, perhaps raising further doubts on whether or not other countries could join in such as the United States. Focusing back on foreign exchange markets, the sentiment-linked Australian Dollar was the best-performing major currency.

Friday’s Asia Pacific Trading Session

The Good Friday holiday means that a few exchanges will be closed during today’s Asia Pacific trading session. While Australian markets are closed, Japanese ones will be online. A lack of major economic data places the focus for foreign exchange markets on risk trends.

Lower-than-usual liquidity conditions are to be expected and given general elevated volatility levels, FX can be susceptible to sudden breaking headlines. Cautious optimism may continue boosting the Aussie while placing the US Dollar at risk. That may also boost gold prices.

Gold Technical Analysis

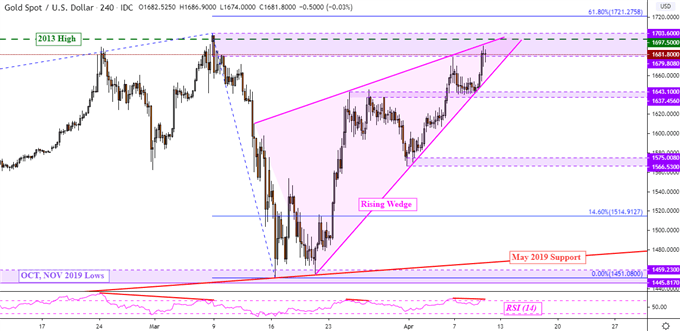

Gold prices may be at risk to a turn lower as the yellow metal approaches a critical resistance barrier. This is a range between 1679 to 1703 which also includes the 2013 peak. In the background, a Rising Wedge has been brewing since prices bottomed last month.

This is a bearish pattern whereby a close under rising support may open the door to a reversal of the near term uptrend. Negative RSI divergence is also present, showing fading upside momentum. A turn lower places the focus on key support at 1643.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

XAU/USD 4-Hour Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter