Australian Dollar, AUD/USD, Fed, U.S. Recession, Coronavirus – Asia Pacific Market Open Points

- Australian Dollar fast approaching 2009 bottom in its aggressive downtrend

- Intense Fed stimulus struggled to uplift markets, U.S. recession in the cards

- Trump said to back airlines amid coronavirus outbreak, virus relief bill eyed

Monday’s Recap – Australian Dollar, Fed, U.S. Recession?

The “growth-oriented” Australian Dollar weakened despite aggressive stimulatory efforts from the central bank of the world’s largest economy. As markets came online after the weekend, the Federal Reserve slashed interest rates to a 0.00 – 0.25% range, which totaled 100bp worth of easing. The Fed also launched an impressive $700b quantitative easing program to help ease markets amid the coronavirus outbreak.

The Dow Jones and S&P 500 closed -12.93% and -11.98% to the downside respectively. This was Wall Street’s worst single-day performance since 1987 after similar declines on Thursday. The Dow is also threatening to overturn a decade-old rising support range. This is as the anti-risk Japanese Yen, haven-linked US Dollar and the Euro gained. The latter seemed to squeeze out what was left of USD’s yield advantage.

The selloff on Wall Street resumed as U.S. President Donald Trump warned that the economy could be heading into a recession amid the pandemic. That is because efforts to combat the virus may last through July or August. Meanwhile counties across the country took measures to increase social distancing. For example, local governments in the Bay Area – a tech hub in California – ordered citizens to remain home.

Tuesday’s Asia Pacific Trading Session

There is a cautious “risk-on” tilt in currencies and futures markets heading into Tuesday’s Asia Pacific trading session. This followed announcements that the U.S. government is going to “100%” back airlines to help cope with significantly-reduced travel due to the virus. Companies such as Boing, Delta and American Airlines are in close talks with the White House as Trump urged citizens to avoid travel.

Meanwhile, the House approved on amendments to the virus bill that was voted on and signed off by Trump last week.Sick leave for workers at big companies were to be expanded. The Senate – which is in session after having this week’s recess canceled – may take up the bill tomorrow. These expectations may support an optimistic tilt in markets, placing the Yen at risk.

The fluid situation of the coronavirus and rising cases outside of China arguably leaves the risk of volatility at high. Gains in equities may appear in the near term, but confirmation in breakouts are key.

Australian Dollar Technical Analysis

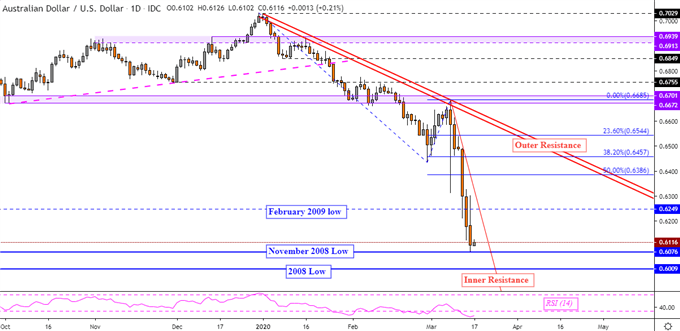

The AUD/USD is fast approaching the 2008 bottom after taking out and confirming a daily close under lows from 2009. Immediate support is the November 2008 low at 0.6076. Maintaining the downtrend is “inner resistance” on the daily chart below. Do keep in mind that down the road, “outer resistance” may come into play and put a pause on a near-term bounce.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

AUD/USD Daily Chart

Chart Created Using TradingView

Can’t see the image? Click here

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter