Asia Pacific Market Open Talking Points

- US Dollar sinks as Fed injects liquidity into markets ahead of rate decision

- EUR/USD climbs but the dominant downtrend still remains intact for now

- Indecision in Asia Pacific markets likely ahead due to proximity of the Fed

Find out what the #1 mistake that traders make is and how you can fix it!

US Dollar Sinks as Fed Injects Liquidity into Markets

The US Dollar weakened towards the latter half of Tuesday’s session after the Federal Reserve injected $53.2b of liquidity into financial markets via repo operations. This was a response to a rise in short-term borrowing costs that was threatening to push the Effective Federal Funds Rate above the 2.00 - 2.25 percent range. These efforts are ahead of today’s widely-anticipated cut to 1.75 – 2.00%, underscoring the urgency.

Meanwhile, the Euro and British Pound outperformed while the pro-risk Australian and New Zealand Dollars ended the day relatively flat. The latter two were under pressure towards the beginning of Tuesday’s session amid lackluster performance in Asia Pacific benchmark stock indexes and dovish RBA meeting minutes. Thus, when USD weakened, AUD and NZD had more lost ground to recover than EUR and GBP.

Wednesday’s Asia Pacific Trading Session

Given the close proximity of the Fed rate decision due later today at 18:00 GMT, we may see Asia Pacific bourses trade relatively flat which may echo into foreign exchange markets. That is because traders may hesitate to commit on large speculative bets ahead of such critical economic event risk. All eyes are on policymakers’ forward guidance with traders at risk to being disappointed by underwhelming dovish bias.

Euro Technical Analysis

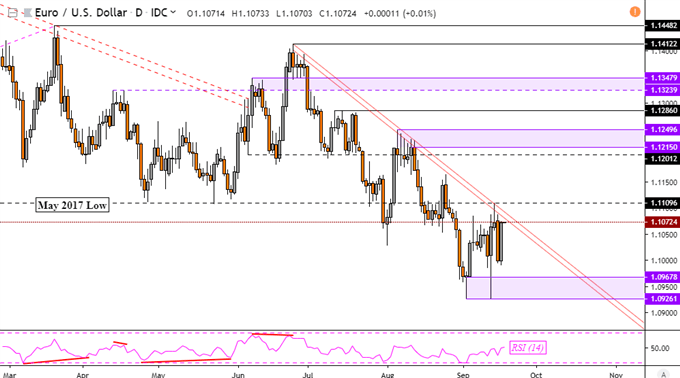

Gains in EUR/USD over the past 24 hours brought it back to retesting the descending range of resistance going back to late June. Thus, the dominant downtrend still holds with a push above 1.1110 opening the door to a reversal. On the other hand, resuming loses paves the way for a test of support which is a range between 1.0926 and 1.0968. Clearing the latter resumes Euro’s downtrend.

EUR/USD Daily Chart

FX Trading Resources

- See how the S&P 500 is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving the US Dollar

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter