Asia Pacific Market Open Talking Points

- US-China trade war news sunk S&P 500

- The pro-risk AUD and NZD depreciated

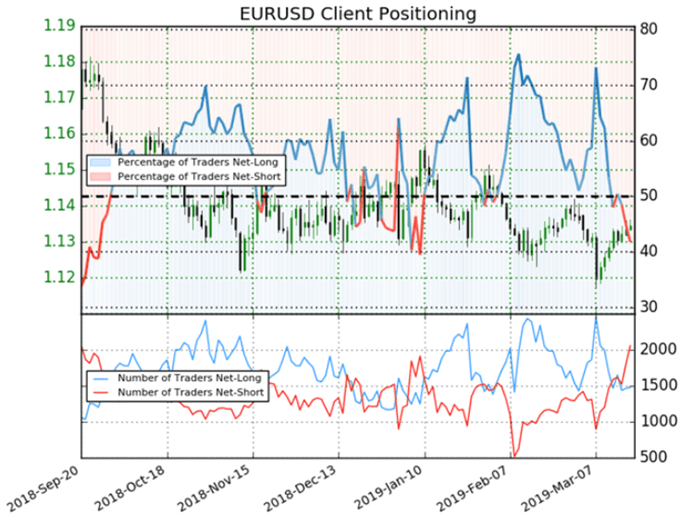

- Sentiment hints bullish EUR/USD outlook

Find out what the #1 mistake that traders make is and how you can fix it!

Key FX Developments Tuesday

Tuesday was a rather quiet day for foreign exchange markets, with the pro-risk Australian and New Zealand Dollars slightly underperforming against their major peers. This followed a pessimistic shift in market mood during the US trading session, depriving the S&P 500 from following gains in European equities. The cause of this concern stemmed from US-China trade war news.

Reports crossed the wires that a few US officials reported seeing China walking back on trade offers. This comes in the aftermath of what has arguably been the most progress seen in negotiations between the world’s largest economies to bring the trade war towards an end. A comment from US President Donald Trump afterwards about talks with China going well fell failed to lift sentiment.

Wednesday’s Asia Pacific Trading Session

The low volatility in currencies could be forgiven as markets eagerly await today’s Fed rate decision. A lack of critical economic event risk during the Asia Pacific trading session as the new day gets underway does place the focus on risk trends.

There, regional bourses may shed some previous gains as local markets digest the sentiment-negative trade war news. Keep an eye on the rising trend line in the Nikkei 225. If it breaks, the anti-risk Japanese Yen may appreciate.

EUR/USD Sentiment Outlook

Looking at the immediate chart below, EUR/USD rose more than 1.4% since March 8th as market positioning became increasingly net short. Recent adjustments in sentiment hint that the outlook for the Euro remains bullish ahead of the FOMC.

Join me in my weekly webinars on Wednesday’s at 00:00 GMT as I cover the prevailing and future trends in markets by taking a look at overall net positioning

EUR/USD Client Positioning

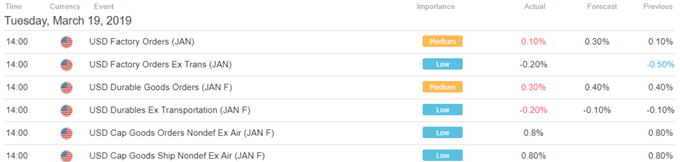

US Trading Session Economic Events

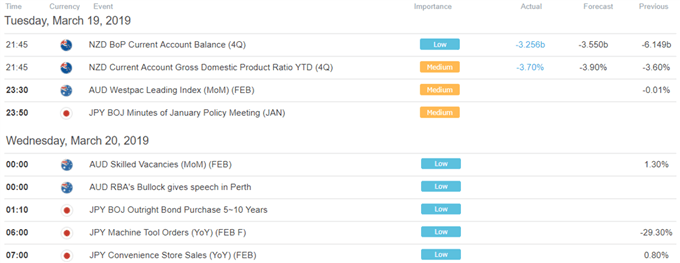

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter