Asia Pacific Market Open Talking Points

- Stellar US jobs report leaves US Dollar, bond yields higher as S&P 500 falls behind

- Anti-risk Japanese Yen falls as Canadian Dollar soars with OPEC output reduction

- Asia Pacific stocks at risk as sentiment sours, ASX 200 upside momentum still fading

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

The anti-risk Japanese Yen underperformed against its major counterparts, weakening particularly during the first half of Friday’s US trading session. A largely stellar local jobs report bolstered sentiment as the S&P 500 soared alongside the US Dollar and falling government bond prices.

Sentiment-linked oil prices also skyrocketed. Shortly before US market open, OPEC reported that monthly production fell by the most in two years. As such, the Canadian Dollar edged cautiously higher against its major peers. Petroleum is a major source of revenue in Canada.

By the end of the day, the US Dollar maintained its rise and so too did local bond yields. The same could not be said for the S&P 500 which trimmed gains to the point it only ended 0.09% higher. In fact, strong domestic data and improvements in external headwinds could be a source of hesitation for US equities.

These seemed to be underpinned by the US unemployment report and what seemed to be progress towards a trade deal with China. Albeit, an outcome on the latter has been pushed back as markets anxiously await resolution. Given these developments, Asia Pacific stocks may struggle following Wall Street higher.

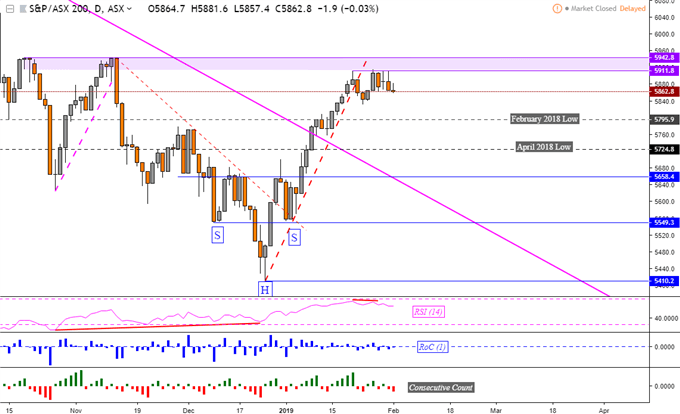

ASX 200 Technical Analysis

Australia’s ASX 200 continues struggling to breach a prominent resistance barrier between 5,911 and 5,942. Time may be running out for the index until it turns lower. Negative RSI divergence warns that upside momentum is fading. Near-term support seems to be the February 2018 lows around 5,795.

ASX 200 Daily Chart

Chart created in TradingView

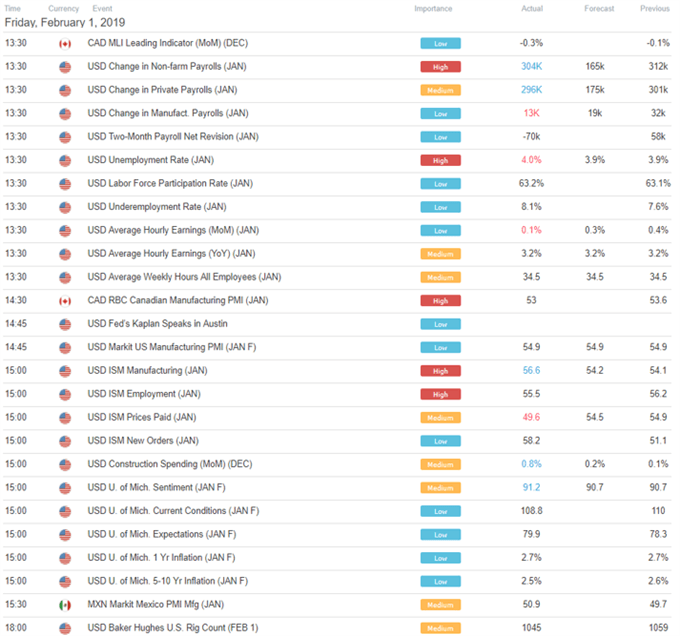

US Trading Session

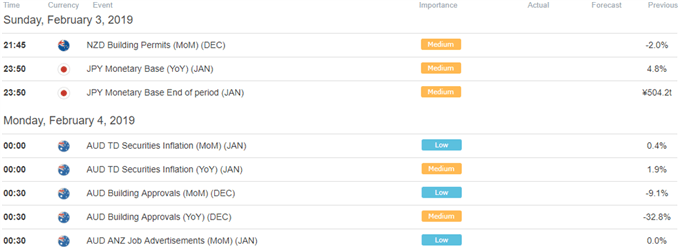

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter