Asia Pacific Market Open – G20 Leaders’ Summit, Fed, US Dollar, Asia Stocks, RBA

- Risk appetite slightly fell apart after G20 Summit boost as US China trade war put on hold

- US Dollar trimmed some losses after 2019 Fed rate hike bets improved thanks to ceasefire

- Asia stocks may struggle gaining if markets focus on the Fed outlook, AUD eyes the RBA

Just getting started trading? See our beginners’ guide for FX traders to learn how you can apply this in your strategy!

The highly anticipated G20 Leaders’ Summit this past weekend resulted in aggressive market-wide risk appetite at the beginning of Monday’s session. US President Donald Trump and China’s Xi Jinping agreed on a 90-day ceasefire that could result in the former holding off from raising tariff rates to 25% come 2019. Until then, China must figure out how it is going to help reduce the US trade deficit.

Equities gapped higher and the pro-risk Australian and New Zealand Dollars appreciated against most of their major counterparts. Meanwhile the anti-risk Japanese Yen underperformed. The US Dollar, thanks to its status as the world’s reserve currency, initially suffered amidst a drop in demand for safe haven assets. However, this trading dynamic started to fall apart as we headed towards the second half of Monday’s session.

As a reminder, the Fed itself expressed concerns about the global growth outlook in 2019, causing the US Dollar’s upside momentum this year to weaken. Meanwhile, institutions such as the IMF downgraded global growth estimates for the year ahead as a result of the US China trade war. With that suddenly looking now more unlikely, perhaps it is not too surprising that the US Dollar trimmed some of its losses later Monday.

In fact, after the S&P 500 gapped higher at market open, it gave up some of its gains and only closed 1.1% higher. Simultaneously, you had an increase in US government bond prices reflecting slight risk aversion. The cause? Well, there was an increase in 2019 Fed rate hike bets. Should US China trade war fears continue deteriorating, it might improve the Fed’s outlook for growth and that may boost the US Dollar.

With that in mind, despite the G20 Summit outcome, the potential for gains in Asia Pacific benchmark stock indexes on Tuesday could be restrained. If markets focus on what reduced trade war fears means for the Fed, it won’t be too surprising to see a little bit of risk aversion. But more details might be made clear at the central bank’s last rate announcement of this year.

Tuesday also brings with it the last RBA rate decision of 2018 and not much of a surprise is expected there. The cash rate target is anticipated to be left unchanged at 1.5%. Unless the Reserve Bank of Australia offers a clearer insight into what we can expect next year, the Australian Dollar will likely focus on risk trends instead. Overnight index swaps are not even fully pricing in one rate hike in 2019.

I will be covering the RBA rate decision webinar live beginning at 3:15 GMT, join for an overview of the Australian Dollar and other Aussie crosses!

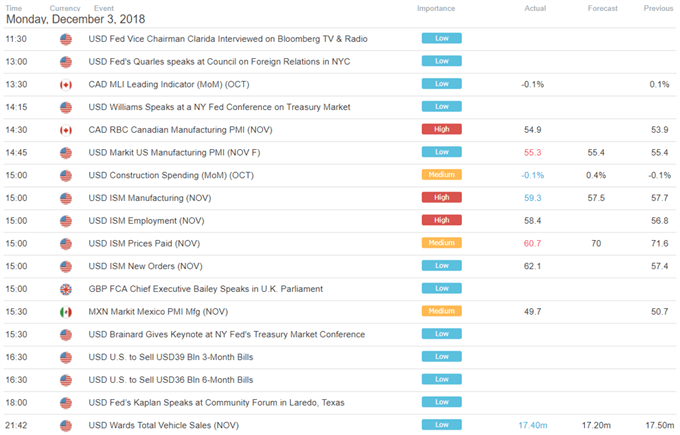

US Trading Session

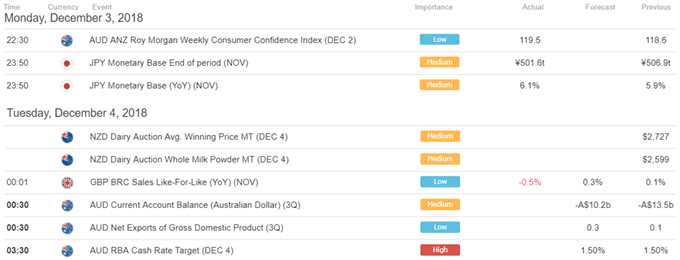

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

Technical Forecast

Aussie Bulls Beware: AUD/USD, AUD/JPY May Fall as EUR/AUD Gains

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter