Central Bank Watch Overview:

- After the September BOE meeting produced a hawkish tone, the new Chief Economist signaled concern over inflation – another hawkish consideration.

- The ECB appears increasingly dovish relative to other major central banks, with prolonged low interest rates and a new round of asset purchases looking likely.

- Retail trader positioning suggests both EUR/USD and GBP/USD rates have bullish biases in the near-term.

The Chasm Widens Between BOE and ECB

In this edition of Central Bank Watch, we’ll cover the two major central banks in Europe: the Bank of England and the European Central Bank. The first week of October has produced greater divergence in the near-term policy path for the BOE and the ECB after the split began to widen in September after both central banks’ policy meetings. While the ECB is signaling its intent to provide more stimulus, the BOE is looking among the more hawkish major central banks.

For more information on central banks, please visit the DailyFX Central Bank Release Calendar.

BOE Rate Expectations Continue to Rise

Last month, Bank of England policymakers began to drop hints that they were embarking on a more hawkish policy path. The September BOE yielded a 7-2 vote that QE should remain unchanged as two policymakers believed the timeline for stimulus withdrawal should accelerate.

The latest hawkish surprise arrived today, when the new BOE Chief Economist, in his first public comments, suggested that tighter monetary policy may soon emerge. BOE Chief Economist Huw Pill said that the “balance of risks is currently shifting towards great concerns about the inflation outlook, as the current strength of inflation looks set to prove more long lasting than originally anticipated.”

The BOE was already shaping up to be one of the more hawkish major central banks over the coming months, and the November Quarterly Inflation Report (QIR) may signal the end of QE with rate hikes arriving in early-2022.

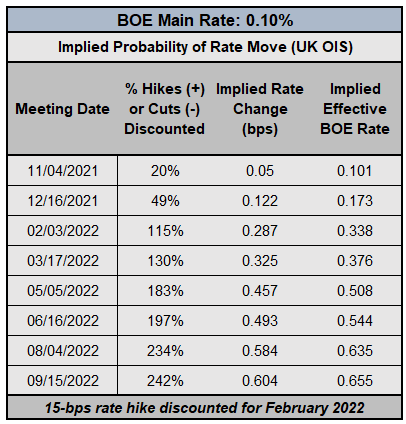

Bank of England Interest Rate Expectations (October 7, 2021) (Table 1)

Rates markets continue to suggest a more hawkish BOE over the coming months. After the September BOE meeting, rates markets were eying February 2022 for a 15-bps rate hike (71% chance). Now, while February 2022 is still discounted to produce the first rate hike, odds have risen to 115%. Furthermore, UK overnight index swaps (OIS) are pricing in a second rate hike of 25-bps arriving in May 2022 (83% chance).

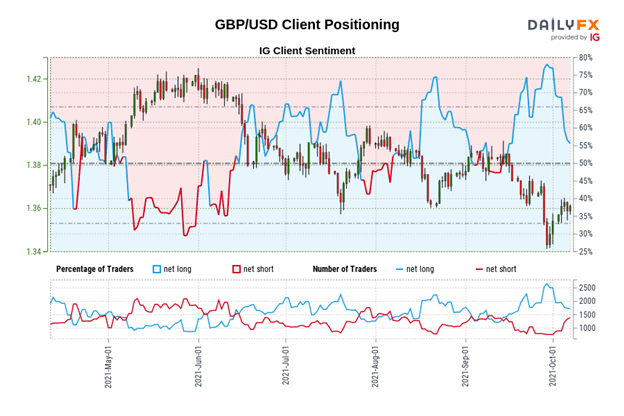

IG Client Sentiment Index: GBP/USD Rate Forecast (October 7, 2021) (Chart 1)

GBP/USD: Retail trader data shows 56.74% of traders are net-long with the ratio of traders long to short at 1.31 to 1. The number of traders net-long is 1.74% higher than yesterday and 33.57% lower from last week, while the number of traders net-short is 3.83% higher than yesterday and 74.27% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

No End to ECB’s QE, Low Rates

The European Central Bank is sending up signal flares that its ultra-accommodative policies will remain in place for the foreseeable future. Reports emerged this week that the ECB would seek to begin a new QE program after the PEPP ended, and ECB Chief Economist Philip Lane added fuel to the fire that the ‘lower for longer’ mindset is engrained.

ECB Chief Economist Lane said that “the red zone for everyone is if inflation became persistent at a number that’s immoderately above the inflation target – that’s a very far distance from where the euro area is,” implicitly suggesting that the ECB will look through rising price pressures and instead keep interest rates on hold for an extended period of time.

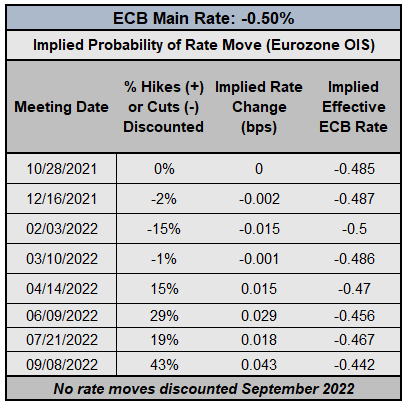

EUROPEAN CENTRAL BANK INTEREST RATE EXPECTATIONS (October 7, 2021) (TABLE 2)

According to Eurozone overnight index swaps (OIS), the ECB will not change rates at any point in the near-future. Through September 2022, there is a only a 43% chance of a 10-bps rate hike, among the most dovish pricing among major centrals. Comparatively, the Fed is expected to have stopped its QE program over the same time horizon, while the BOE may already have hiked rates two times.

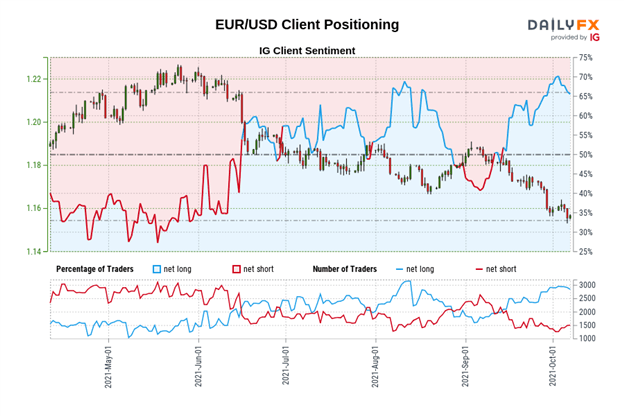

IG Client Sentiment Index: EUR/USD Rate Forecast (October 7, 2021) (Chart 2)

EUR/USD: Retail trader data shows 62.78% of traders are net-long with the ratio of traders long to short at 1.69 to 1. The number of traders net-long is 1.77% lower than yesterday and 3.71% lower from last week, while the number of traders net-short is 16.07% higher than yesterday and 22.07% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

--- Written by Christopher Vecchio, CFA, Senior Strategist