Central Bank Watch Overview:

- With Eurozone economic data shrugging in recent weeks, European Central Bank interest rate expectations have been creeping forward towards April 2021.

- Neither the Bank of England nor the Federal Reserve are expected to move on rates for the rest of 2020; and while the Fed is on hold for the foreseeable future, the BOE could cut rates again in August 2021.

- Retail trader positioning suggests that the US Dollar has a bullish trading bias.

Bank of England May Cut Rates in August 2021

The final round of EU-UK trade negotiations are taking place this week, thanks in part to a self-imposed deadline of October 15 on behalf of UK Prime Minister Boris Johnson. While the British Pound has experienced a fair deal of volatility in recent weeks as the specter of a hard Brexit came back into focus, it seems difficult to envision that the current impasse – one over fishing quotas and competition rules – will derail the entire process.

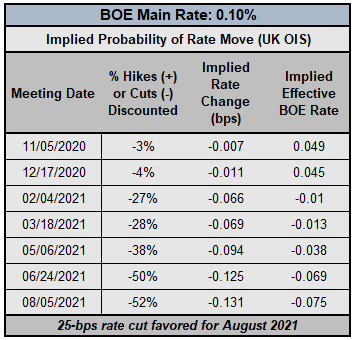

Bank of England Interest Rate Expectations (SEPTEMBER 29, 2020) (Table 1)

To this end, Bank of England interest rate odds have proved stable. Conversation around negative interest rates remains premature at best, insofar as rates markets don’t foresee that kind of possibility from truly emerging until August 2021. An EU-UK trade agreement would further reduce the likelihood of a shift into negative interest rate territory by the BOE.

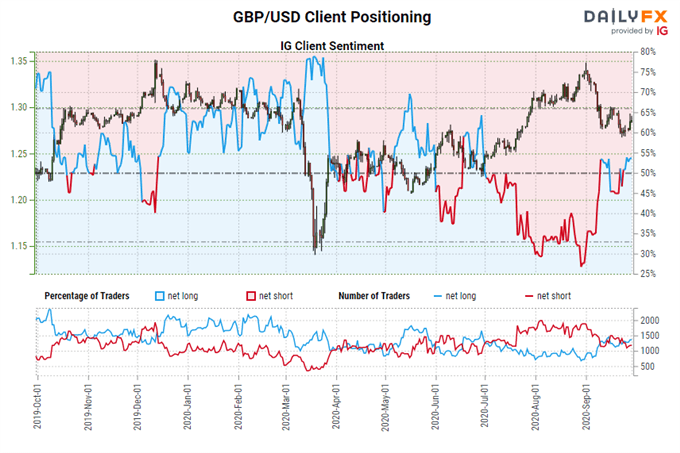

IG Client Sentiment Index: GBP/USD Rate Forecast (SEPTEMBER 29, 2020) (Chart 1)

GBP/USD: Retail trader data shows 56.58% of traders are net-long with the ratio of traders long to short at 1.30 to 1. The number of traders net-long is 20.15% higher than yesterday and 42.45% higher from last week, while the number of traders net-short is 4.80% lower than yesterday and 20.06% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

European Central Bank Rate Cut Odds Pulled Forward

Quietly since the middle of August, there has been backdrop of steadily deteriorating economic data coming out of the Eurozone. In tandem, European Central Bank interest rate expectations have started to inch higher, suggesting that an interest rate cut deeper into negative territory will arrive sooner in the first half of 2021 than previously anticipated. The Citi Economic Surprise Index for the Eurozone, a gauge of economic data momentum, currently sits at 41.8 today, down from its high of the year set on August 11 at 212.40.

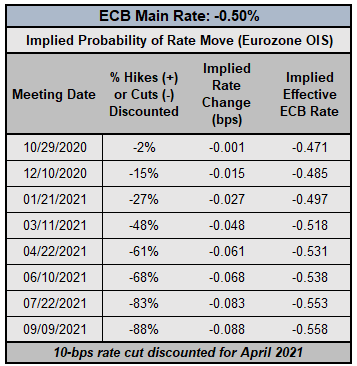

EUROPEAN CENTRAL BANK INTEREST RATE EXPECTATIONS (SEPTEMBER 29, 2020) (TABLE 2)

According to Eurozone overnight index swaps, there is only a 15% chance of a 10-bps interest rate cut by the end of 2020. But interest rate cut odds have been pulled forward in recent weeks: in mid-August, OIS pricing favored June 2021 with 54% odds for the next rate move. Now, as the third quarter comes to a close, April 2021 is favored with an implied probability of 61%.

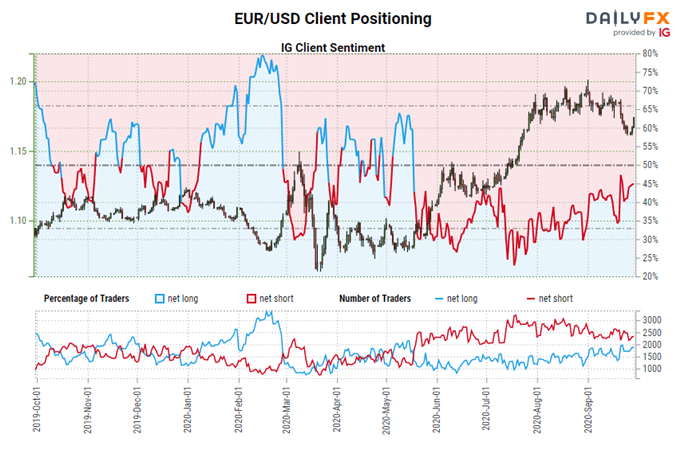

IG Client Sentiment Index: EUR/USD Rate Forecast (SEPTEMBER 29, 2020) (Chart 2)

EUR/USD: Retail trader data shows 46.58% of traders are net-long with the ratio of traders short to long at 1.15 to 1. The number of traders net-long is 2.25% higher than yesterday and 10.02% higher from last week, while the number of traders net-short is 0.55% lower than yesterday and 10.13% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

Federal Reserve Maintaining Low Rates, Not Negative Rates

It still holds that little has changed with respect to the Federal Reserve, having enacted emergency interest rate cut measures and a slew of balance sheet-expanding operations. To this end, interest rate markets are still stuck in a state of suspended animation. Should the Fed change course, it will likely shift to via more QE, a repo facility, Municipal Liquidity Facility, etc.

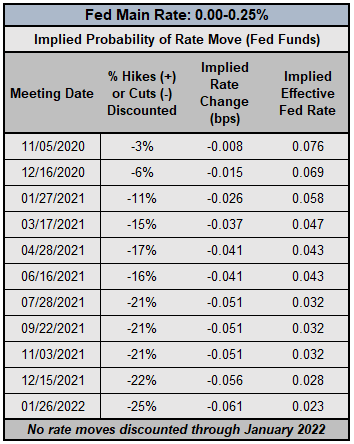

FEDERAL RESERVE INTEREST RATE EXPECTATIONS (SEPTEMBER 29, 2020) (Table 3)

Seeing as how there’s been no indication thus far that the Fed will cut interest rates into negative territory,we’ve reached the lower bound for the time being. In the future, if yield curve control is implemented, we would expect a similar outcome to what is being experienced by the Reserve Bank of Australia main rate expectations curve, especially now that the Fed has extended its promise to keep rates low through 2023.

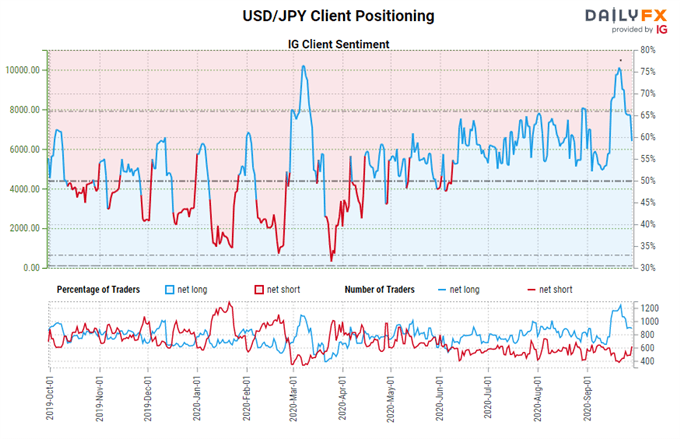

IG Client Sentiment Index: USD/JPY Rate Forecast (September 29, 2020) (Chart 3)

USD/JPY: Retail trader data shows 58.86% of traders are net-long with the ratio of traders long to short at 1.43 to 1. The number of traders net-long is 3.30% lower than yesterday and 32.36% lower from last week, while the number of traders net-short is 6.20% higher than yesterday and 52.77% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse higher despite the fact traders remain net-long.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist