Top FX News Talking Points

- Fed Chair Jerome Powell says that the Fed is “closely monitoring” impact of trade developments and it will “act as appropriate” to help sustain the US’ near-record long expansion.

- Rates markets have now begun to price-in three rate cuts over the next year, a major reason why the US Dollar has been dragged lower in recent days.

- Retail traders are buying the US Dollar on dips, suggesting that DXY Index losses may continue in the near-term.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

The US Dollar has seen prices decline significantly in recent days, thanks largely due to the growing threat of US-led trade wars. With US President Donald Trump across the pond for a visit to the UK, news flow around real trade developments has slowed somewhat. But markets are open and moving, suggesting that traders feel that changes in both fiscal and monetary policies over the coming months will have profound influences on US Dollar price action for the next several years.

Fed Chair Powell on US-led Trade Wars

With the prospect of a US-Mexican trade war front opening up as the US-China trade war intensifies, Fed Chair Powell has found good reason to speak out against the potential consequences of trade frictions. With estimates showing that the steepest tariffs against China and Mexico could detract around 1% of US GDP, Fed Chair Powell has said that policymakers are now “closely monitoring” the impact of trade developments.

To this end, as the US recovery approaches 10 years old next month – the longest stretch of economic growth in US history – Fed Chair Powell has also said that the Fed will “act as appropriate” to help sustain the expansion.

What Would Be an Appropriate Fed Response to Trade Wars?

Last week we noted that “if the Fed is going to get involved in trade wars, then it is highly likely that it will do so along the interest rate route…traders would be wise to watch how US rates markets have evolved in recent days as trade war concerns have skyrocketed.” Indeed, given how rates markets have moved in the past week, it’s of little surprise why the US Dollar has been hit so hard over the past few days.

Fed Funds Pricing Two Potential Rate Cuts in 2019

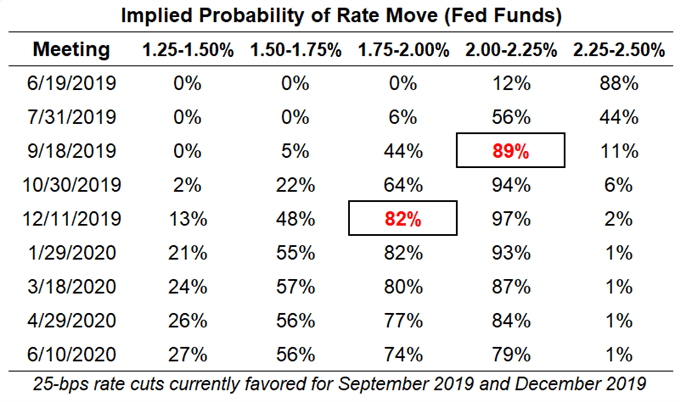

The probability of policy loosening by the Federal Reserve in 2019 has increased significantly over the past week. Prior to the May Fed meeting, there was a 68% chance of a 25-bps rate cut by the end of the year; those odds now stand at 97%. Overall, there is an 89% chance of a first Fed rate cut by September and an 82% chance of a second Fed rate cut by December.

Federal Reserve Rate Hike Expectations (June 4, 2019) (Table 1)

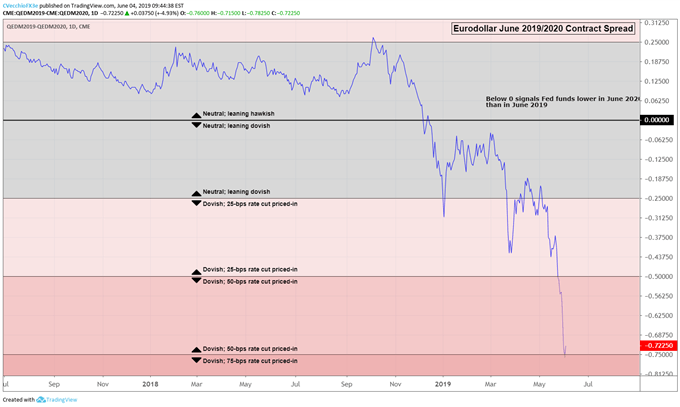

We can measure whether a rate cut is being priced-in by this time next year by examining the difference in borrowing costs for commercial banks over a one-year time horizon in the future. Over the past two weeks, rate expectations have been rapidly pricing in a cut, with rates markets discounting -73-bps by June 2020; this is a 18-bps increase from this time last week.

Eurodollar June 2019/2020 Spread: Daily Timeframe (October 2018 to June 2019) (Chart 1)

Rate pricing has changed dramatically since the end of April as the Eurodollar June 2019/2020 contract spread collapsed dramatically in May. Whereas one 25-bps rate cut was priced-in at the start of May, now two cuts (or 50-bps) are priced-in; rates markets are effectively pricing-in three 25-bps rate cuts by the Federal Reserve between now and June 2020.

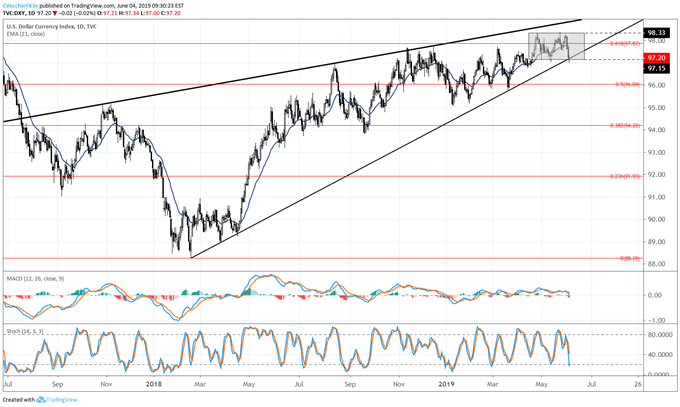

US DOLLAR TECHNICAL ANALYSIS (DXY INDEX): DAILY PRICE CHART (JUNE 2018 TO MAY 2019) (CHART 2)

As Fed rate cut expectations have been dragged forward in recent days, the price forecast for the US Dollar (via the DXY Index) has weakened materially. Foremost, the DXY Index has fallen back to five-week range support near 97.15. Additionally, the DXY Index is now looking at a retest of the rising trendline from the February 2018, March 2018, and March 2019 low lows – the backbone of the entire bull move.

As far as this strategist is concerned, if the DXY Index closes below 97.15 this week it would signal not only the start of a double top pattern pointing towards 95.97/96.00 in the near-term, but longer-term major topping potential in the form of a bearish rising wedge – which would ultimately call for the DXY Index to decline back towards its 2018 lows near 88.25 over the next 16-months.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail at cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides