Equity Analysis and News

- FTSE 100: No-Deal Likely to be Rejected, A50 Extension Favoured

- S&P 500: Familiar Resistance Holds Firm

Source: Thomson Reuters, DailyFX

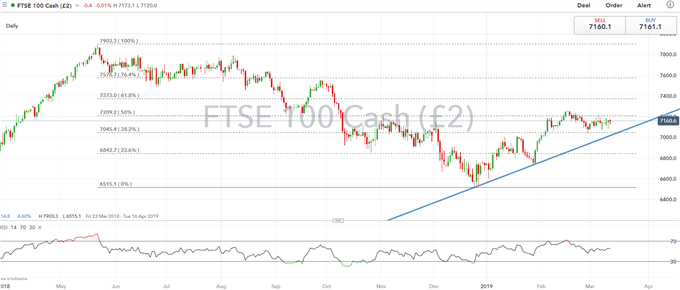

FTSE 100: No-Deal Likely to be Rejected, A50 Extension Favoured

Despite the sizeable swings in GBP, the FTSE 100 has held a relatively tight range throughout the week (7080-7180), as the downside pressures of a stronger currency had been offset by the general improvement in risk sentiment. With the FTSE 100 edging towards 7200, further upside looks somewhat limited. Today will likely see MPs vote against a no-deal Brexit, while tomorrow will likely see MPs voting in favour of an Article 50 extension in tomorrow’s vote. Consequently, GBP may well hold onto its recent gains albeit capped at 1.33, which in turn could act as a stumbling block for the FTSE 100. Alongside this, key resistance for the index is seen at 7254 (200DMA), while the 50% Fibo retracement situated 7210 may also ease upward momentum.

Given that markets have attached a low probability of tonight’s vote passing, the vote itself may not provide too much in the way of volatility. As such, eyes will be firmly fixed on the latest Brexit headlines emerging from No. 10 or the EU throughout the session.

- March 13th (No-Deal Vote if WA fails)

- March 14th (A50 Extension if No-Deal fails)

FTSE 100 Price Chart: Daily Time Frame (Mar 2018-Mar 2019)

S&P 500: Familiar Resistance Holds Firm

The recovery in the S&P 500 has once again stumbled at the 2800 level. As US data continues to soften the outlook for US equity markets remain somewhat fragile. However, the current themes of US-China trade wars and an accommodative Fed are likely to keep the index supported. As such, near-term support at 2750 may indeed hold for now, while upside looks to be yet again capped from 2800-2820.

S&P 500 Price Chart: Daily Time Frame (Aug 2018 – Mar 2019)

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX