Equity Analysis and News

- S&P 500: Risk Barometer Provides Concern for US equities

- FTSE 100: Deal, No-Deal, Article 50 Extension

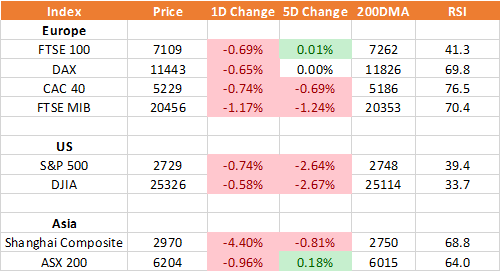

Source: Refinitiv

Risk Barometer Provides Concern for US equities

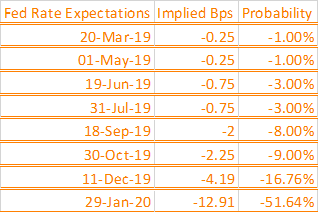

Having failed to consolidate above 2800, the S&P 500 had been edging lower throughout the week with concerns over the global economic outlook continuing to weigh on risk sentiment. Consequently, defensive stocks (XLP) have been outperforming relative cyclicals (XLI). A continuation of this would not bode well for equity markets, as evidenced by the sell-off in Q4. Alongside this, while equity have rallied since the beginning of the year, equity flows however, have seen the worst start to a year since 2008 with another $10bln worth of outflows this week, according to EPFR.

Fed’s Patience to be Reinforced

Over the weekend, Federal Reserve Chairman is scheduled to speak, in which it is likely he will continue to reinforce patience with regard to monetary policy. While the sizeable miss on the headline NFP figure, enforces this message, the continued lift in wage pressures has begun to raise stagflation concerns. As such, eyes will be on the upcoming CPI report, which is particularly important given that the Fed continue to reiterate that inflation pressures remain muted.

S&P 500 Price Chart: Daily Time Frame (Aug 2018 – Feb 2019)

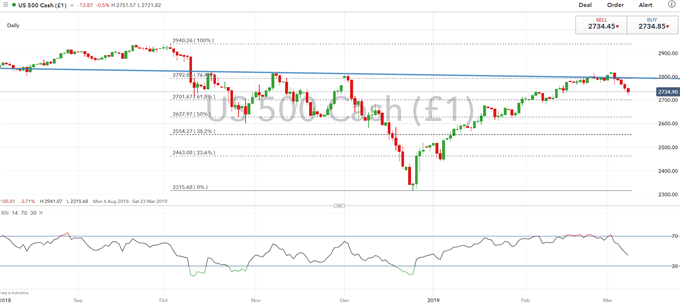

FTSE 100: Deal, No-Deal, Article 50 Extension

The FTSE 100 has held up relatively well against its major counterparts, posing marginal gains for the week. However, with the Brexit votes looming, volatility is expected to pick up and will likely remain the dominant theme for UK asset classes. Near-term support situated at 7040, in which a closing break below could see a test of the psychological 7000.

- March 12th (Withdrawal Agreement vote)

- March 13th (No-Deal Vote if WA fails)

- March 14th (A50 Extension if No-Deal fails)

FTSE 100 Price Chart: Daily Time Frame (Feb 2018-Feb 2019)

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX