GOLD, XAU/USD, US DOLLAR, FED, FOMC, YIELDS, BITCOIN - Talking Points

- Gold had a look at a topside breakout but was thwarted by the Fed

- Hawkish FOMC meeting minutes gave yields a boost, lifting USD

- With large daily moves, can XAU/USD eventually develop a trend?

Gold has been caught in US Dollar gyrations to start the year. Faster than previously anticipated tightening of monetary policy from the Federal Reserve continues to lift rates across the curve and this has underpinned the ‘big dollar’.

The minutes from the December Federal Open Market Committee (FOMC) meeting were released on Wednesday.

The document showed an inclination from members to consider accelerating the tapering of asset purchases and then to make hiking rates a ‘live’ option at the March meeting.

The market is now pricing in a high probability of a 25-basis point hike at that date.

The 10-year US Treasury yield hit its highest level since April last year at 1.71% overnight. At the same time, the 2-year bond continues to surge to yields not seen since the pandemic began, trading above 0.83%

As rates go up, holding dollars provides a more attractive investment option than bullion.

Earlier this week, an investment bank cited bitcoin as stealing market share from gold as a place of stored value. The two have similar characteristics as neither offer a return for ownership but are viewed as a reserve against the collapse of fiat currencies.

Looking ahead, there is a plethora of data out of the US today, including numbers on trade, jobs, factory orders and durable goods orders, as well as the ISM services index.

Trading Strategies and Risk Management

Bollinger Bands®

Recommended by Daniel McCarthy

GOLD TECHNICAL ANALYSIS

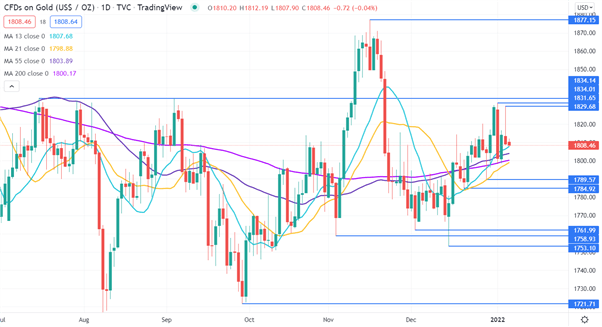

Gold has twice failed to overcome pivot point resistance at 1834.00 this week. The pivot point was generated by a double top seen in July and September last year and may continue to offer resistance.

The 2 recent highs at 1829.68 and 1831.65 might add resistance near that pivot point. Higher up, the November peak of 1877.15 could offer resistance.

Just below the current price, there is a cluster of short, medium and long term simple moving averages (SMA) that are potentially supportive.

Lower down. support could be at the pivot points and previous lows of 1789.57, 1784.92,

1761.99, 1758.93, 1753.10 and 1721.71.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter