Short: AUD/USD

Pending Short: AUD/JPY

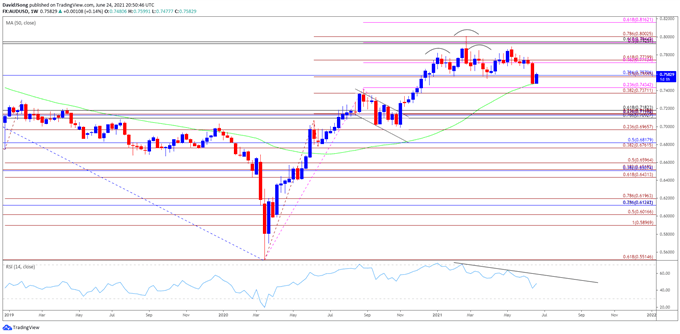

AUD/USD Weekly Chart

Source: Trading View

AUD/USD trades to a fresh 2021 low (0.7477) in June as Federal Reserve officials project two rate hikes for 2023, and the exchange rate may continue to give back the V-shape recovery from 2020 as the Reserve Bank of Australia (RBA) appears to be on track to retain the current course for monetary policy.

Keep in mind, AUD/USD negated the threat for a head-and-shoulders formation amid the string of failed attempts to close below the neckline around 0.7560 (50% expansion) to 0.7570 (78.6% retracement), but the break of the April low (0.7532) as pushed the exchange rate up against the 50-Week SMA (0.7485) for the first time since June 2020. The Relative Strength Index (RSI) highlights a similar dynamic as the indicator establishes a downward trend and sits at its lowest reading in over a year, and it remains to be seen if the decline from February high (0.8007) will turn out to be a correction in the broader trend or a key reversal in market behavior amid the diverging paths between the Fed and RBA.

With that said, failure to hold above the 50-Week SMA (0.7485) may push AUD/USD towards the former resistance zone around0.7370 (38.2% expansion) to 0.7390 (38.2% expansion), with the next area of interest coming in around 0.7090 (78.6% retracement) to 0.7180 (61.8% retracement).

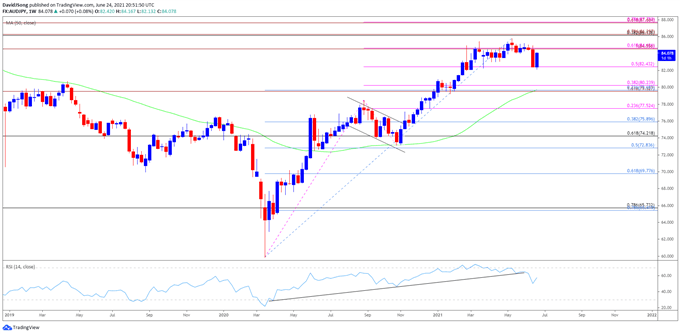

AUD/JPY Weekly Chart

Source: Trading View

AUD/JPY has outperformed its US counterpart as it climbed to a fresh yearly high (85.80) in May, and the exchange rate may continue to exhibit the bullish price action from earlier this year as it holds above the March low (82.09).

However, the Relative Strength Index (RSI) appears to have diverged with price as it failed to push into overbought territory in May, and the oscillator may continue to show the bullish momentum abating as it snaps the upward trend carried over from the previous year.

With that said, AUD/JPY may face a correction over the coming months as the V-shape recovery from 2020 stalls ahead of the Fibonacci overlap around 86.10 (38.2% retracement) to 86.30 (78.6% expansion), with a close below the 82.40 (50% expansion) region on a weekly timeframe bringing the 79.50 (161.8% expansion) to 80.20 (38.2% expansion) area on the radar.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong