2020 Election, Biden-Trump Presidential Debate, Market Outlook, Election Polls - Talking Points

- How will financial markets react leading up to, during and following the first presidential debate?

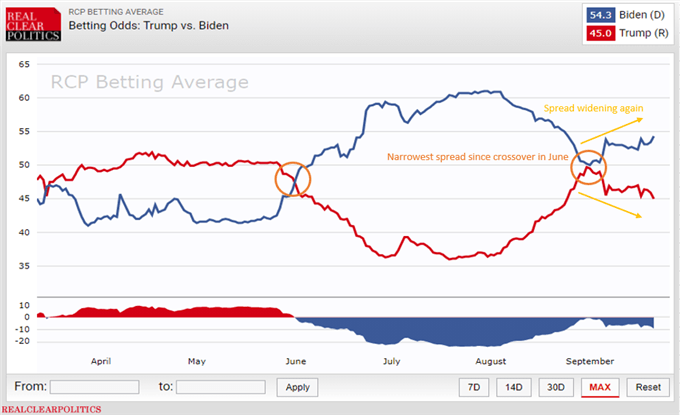

- Biden continues to maintain sturdy lead over Trump in general election polls, average betting odds

- What topics will be discussed and how have past debates influenced voters ahead of the election?

ALL YOU NEED TO KNOW BEFORE THE FIRST PRESIDENTIAL DEBATE

- Who are the candidates?

- When is the debate?

- Who is moderating it?

- What topics will be discussed?

- How will financial markets react?

The first presidential debate of the 2020 election between former Vice President and Democratic nominee Joe Biden and President Donald Trump will be held on September 29 from 9:00-10:30 P.M. ET. The event is set to take place at Case Western Reserve University in Cleveland. Fox News anchor Chris Wallace will be moderating the debate.

The nonpartisan Commission on Presidential Debates (CPD) announced that the debate will be broken up into six 15-minute sections. Each candidate will be given two minutes to respond to each question at the start of every segment. To get additional details of future presidential and vice presidential debates, see the CPD’s official schedule here.

In the previous election, the first debate between then Democratic nominee and former Secretary of State Hillary Clinton and Donald Trump drew a record or 84 million views. Up until that point, the Carter-Reagan debate in the 1980s had the most views at 80.6 million. Given the economic, political and social turbulence this year, it would not be surprising to see this debate top the previous election’s record.

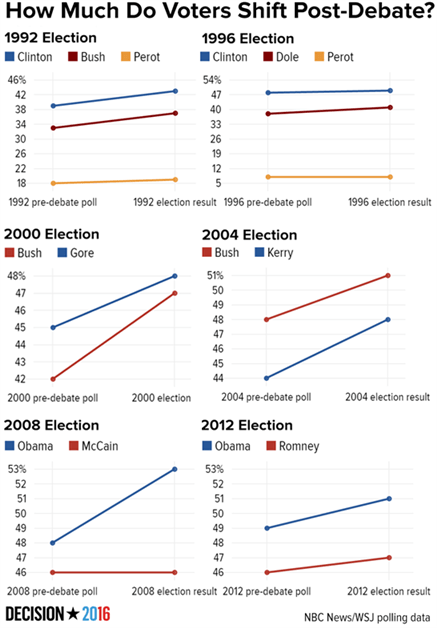

With so much on the line given the diverging policy approaches between Biden and Trump – and their multi-iterated implications – viewers may be particularly keen on tuning in this year. Generally, research has shown that debates do not appear to have a significant impact on shifting voters’ allegiances. For the past almost three-decades – apart from 2016 – the candidate that led going into the debate always won the election.

While the CPD warned that the debate topics are “subject to possible changes because of news developments”, the non-partisan commission has outlined the following themes that will be discussed:

- The Trump and Biden Records

- The Supreme Court

- Covid-19

- The Economy

- Race and Violence in our Cities

- The Integrity of the Election

From a market-oriented perspective, investors will be keen on watching the candidates’ responses to questions about the economy and the coronavirus pandemic. Their respective answers will likely carry policy implications with them that markets may then price in and re-allocate capital accordingly. That re-arrangement of different asset mixtures may manifest as volatility.

The other topics may only impact markets to the extent Biden’s or Trump’s responses to them influence their standing in the polls. Generally speaking – apart from a brief but intense narrowing spread in late-August – President Trump has been trailing Biden in national betting averages. Swing states remain up in the air, but the former Vice President’s performance thus far shows a promising trajectory.

How Will Financial Markets React to Presidential Debates?

So far, the election has not had a clear or tangible impact on financial markets as investors contend with more immediate issues like surging coronavirus cases and bipartisan intransigence over another stimulus bill. Having said that, the first presidential debate may be where markets experience politically-induced volatility from the election.

If polls show Mr. Trump’s popularity growing after the debate, sentiment may turn sour and push the haven-linked US Dollar higher along with the anti-risk Japanese Yen. Cycle-sensitive FX like AUD and NZD may retreat with growth-anchored commodities like crude oil. The prospect of Trump’s reelection from a market-oriented perspective may mean another four years of cross-continental trade wars and tension with China.

Conversely, if Biden outperforms, we may see this dynamic reverse. The former Vice President’s approach to international and domestic policy falls more in line with the pre-2016 status quo. For investors, this may mean less uncertainty and an environment conducive for risk-taking both in speculative investments and – from the perspective of businesses – expanding cross-border investment.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter