CLO ETF, Japanese Yen, Coronavirus, Credit Risks - Talking Points:

- CLO ETF now available for retail investors to trade for the first time

- Illiquidity, hyper-specializedmarket may pose financial stability risks

- JPY and USD may surge ifcredit markets crater as they did in March

On Wednesday, the first collateralized loan obligation (CLO) ETF was made available to trade through the use of an actively managed fund overseen by Alternative Access Funds. It invests only in AAA-rated CLOs which are given a credit rating only by nationally recognized statistical ratings organizations (NRSROs).

Unsure on what a CLO is or how it works? See my primer here.

The current market environment of cautious optimism and appetite for risky assets may initially be a tailwind for the newly-released CLO ETF. Corporate bond inflows have been relatively strong when taking into consideration the fundamental circumstances of the global economy and state of cross-continental geopolitical affairs.

The Fed’s various credit facilities that permitted the purchasing of corporate bonds and in some cases CLO s has also bolstered appetite for corporate debt. This dynamic is amplified in an environment of depressed yields, and CLOs - and by extension, ETFs that track them - offer a comparatively more attractive return for investors seeking to achieve their growth target.

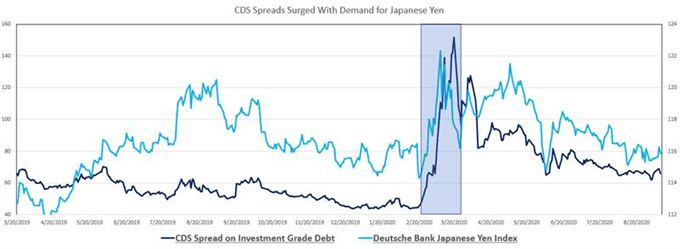

CLOs have been getting increasingly scrutinized following the coronavirus-induced selloff in March. During that time, spreads on credit default swaps for investment and sub-investment grade corporate debt surged with fears of insolvency and general stability in credit markets. The US Dollar and Japanese Yen spiked in tandem.

The highly-specialized nature of these credit instruments - and consequently, their comparative illiquidity relative to non-alternative assets - has been a point of concern. The mass introduction of an ETF that allows retail investors to get exposure to the CLO market - without perhaps fully understanding how they function - could pose a financial stability risk.

“CLO securities present risks similar to those of other types of credit investments, including default (credit), interest rate and prepayment risks. In addition, CLOs are often governed by a complex series of legal documents and contracts, which increases the risk of dispute over the interpretation and enforceability of such documents relative to other types of investments” - Alternative Access Funds Prospectus

The significant uncertainty that Covid-19 poses to the global economy makes financial markets prone to unusually-aggressive bouts of volatility. The relative illiquidity of CLOs and their leveraged nature could compound the selloff. As a result, the AAA ETF which tracks this market, may expose traders to a degree of vulnerability that they are not accustomed to:

“While CLOs in which the Fund seeks to invest are expected to be highly liquid and supported by an active market, it is possible that they may be characterized as illiquid securities under adverse market conditions resulting in a limited market for the resale of CLOs or affecting the liquidity in the fixed income market, generally” - Alternative Access Funds Prospectus

If economic or financial stability concerns rise again, precarious credit markets may get rattled and induce violent price swings in CLOs. Demand for the anti-risk JPY and haven-linked USD may surge in this environment as they did in March. Looking ahead, growing coronavirus cases could catalyze another bout of volatility in tandem with the upcoming US election.

JPY Index, CDS Spreads for Investment Grade Debt

Source: Bloomberg

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter