Australian Dollar, New Zealand Dollar, British Pound, AUD/NZD, GBP/AUD – TALKING POINTS

- GBP/AUD selloff is stalling at critical juncture just above a three-year uptrend

- Cracking the slope of appreciation with follow-through could catalyze a selloff

- AUD/NZD has again failed to break five-year resistance – what happens next?

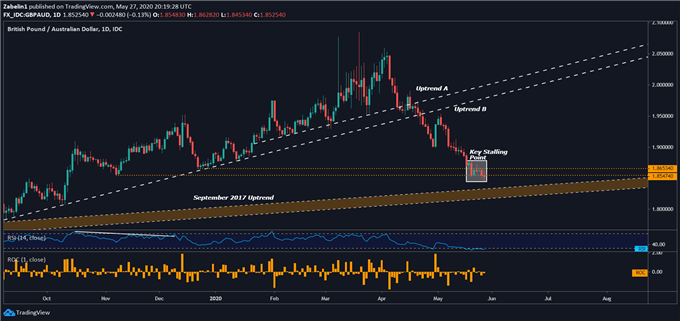

GBP/AUD Forecast

GBP/AUD is stalling at key price shelves in a multi-month support range between 1.8653 and 1.8547 (gold-dotted lines). If selling pressure does not abate and the pair breaks below the lowest tier, it could expose the three-year uptrend. Shattering that with follow-through could mark a tectonic shift in the pair’s trajectory and could potentially catalyze a selloff of notable magnitude.

GBP/AUD – Daily Chart

GBP/AUD chart created using TradingView

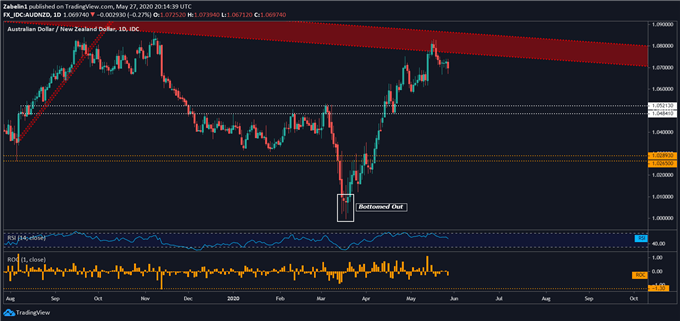

AUD/NZD Outlook

After bottoming out at a multi-year low, AUD/NZD quickly rebounded over 6.80 percent and shattered several ceilings along its ascent. However, recent price action suggests the pair may experience a pullback. While past performance is not indicative of future results, AUD/NZD has once again failed to break through a five-year descending resistance channel.

AUD/NZD – Daily Chart

AUD/NZD chart created using TradingView

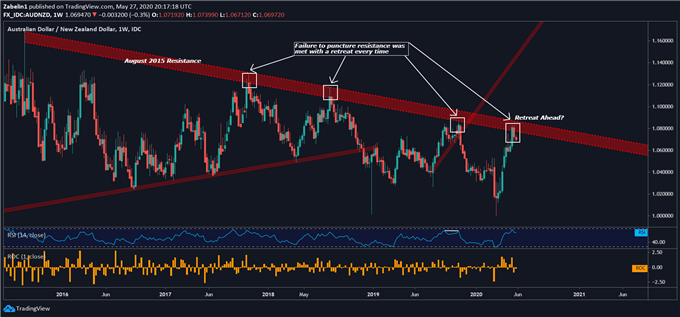

Looking at a monthly view shows every prior attempt to breach the slope of depreciation has subsequently been met with a retreat. The scope of the potential pullback is unclear, though capitulation again could cast a bearish shadow over the pair and aggravate selling pressure. See the fundamental backdrop for AUD in the week ahead here.

AUD/NZD – Weekly Chart

AUD/NZD chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter