How to Invest During a Recession – Main talking points:

- A recession is typically accompanied by falling stock prices, but equities are not the be-all and end-all for recession investment strategies

- To be sure, certain sectors of the stock market can still increase in value during a recession

- However, the currency and commodity markets can create positive returns and provide diversification as the economy slows and risks mount

As the current global growth outlook becomes increasingly uncertain, traders and investors have voiced concern over the possibility of a looming recession – a worrisome prospect for global equity markets. Technically defined as two successive quarters of negative GDP growth, recessions are a period when an economy contracts and company profits slip. Consequently, stock valuations are frequently adjusted lower and producing a positive return in an equity-heavy portfolio becomes a tedious task.

What Are Some of the Best Investments During a Recession?

1. Equity Market: Stocks to Watch During a Recession

Under expansionary circumstances, stocks that have strong growth prospects for the future typically command lofty valuations and produce high returns as investors bank on the company’s ability to generate more income as time progresses. This phenomenon typically results in high price to earnings (P/E) ratios like those currently present in some of the market-leading tech stocks. In the event of an economic downturn, however, these profit-hopeful stocks are often discarded as investors align their income assumptions with slowing growth and lower consumer spending.

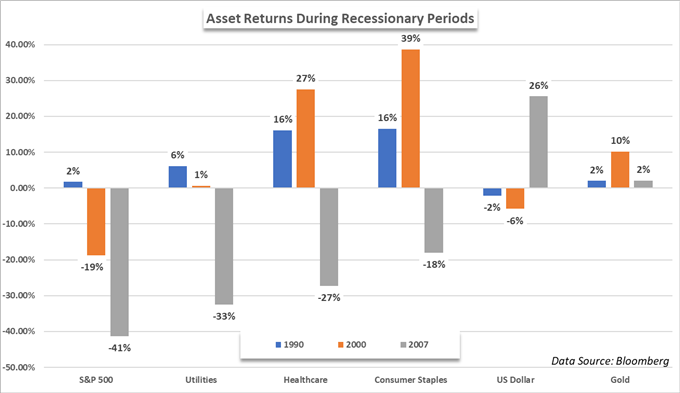

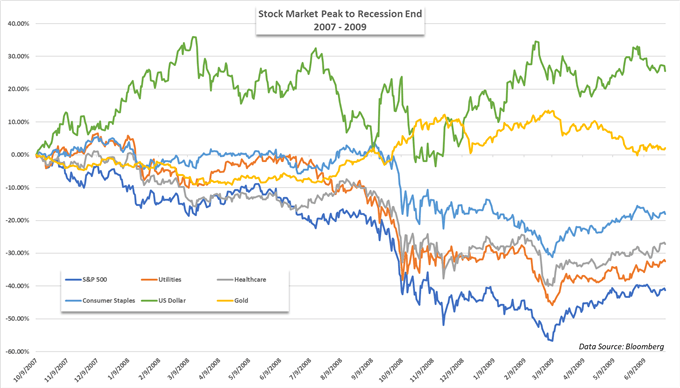

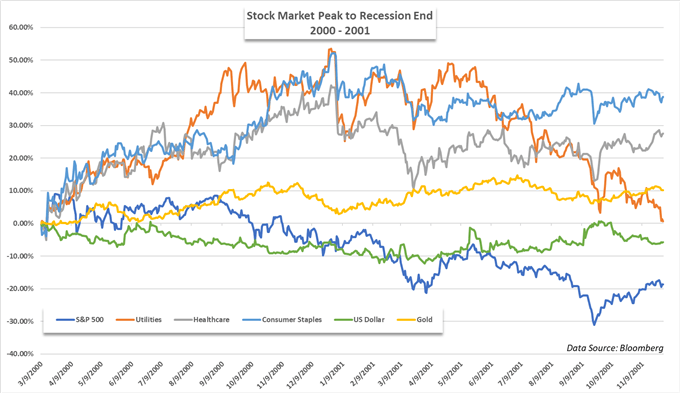

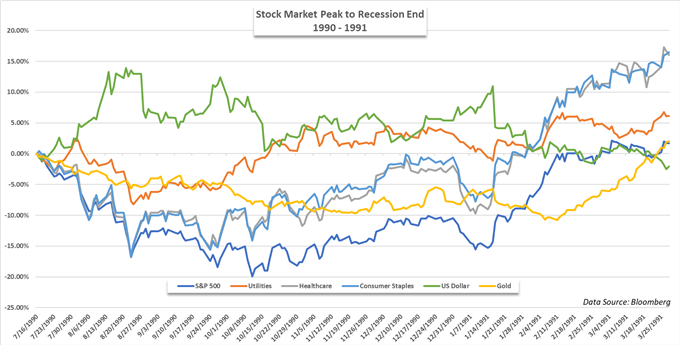

“Recessionary periods” defined as nearest stock market peak prior to recession to end of technical recession

On the other hand, stocks with stable – but often more modest – income generation tend to be more insulated from dramatic stock shocks that frequently accompany recessionary periods. These stocks are known as “defensives” and, broadly speaking, include the utility, healthcare and consumer staple sectors. Given their profitability profiles, they become an important collection of stocks to keep an eye on when the broader market encounters a rough patch.

Still, defensive-natured equities share a positive correlation with the broader S&P 500, Dow Jones and Nasdaq 100, which means if the overall market slips, they too should fall – just not as far.

Consequently, a portfolio comprised entirely of equities is remarkably vulnerable in times of recession, particularly at the onset when losses are often steepest. With that in mind, it may prove beneficial to look outside of the equity market for some of the best recession-proof investments.

2. Gold as an Investment During Recessions

To that end, we shift our focus to the commodity market and more specifically, gold. XAU/USD is widely regarded as a safe haven asset for its stable store of value and tangibility. Further still, gold can act as an inflationary hedge, making it an attractive investment in times of recession and in periods of lower interest rates when inflation may threaten to take hold.

As displayed in the graphs above, gold has demonstrated an almost innate ability to retain its value during contractionary periods thus making it an attractive investment in times of uncertainty.

Learn more about gold trading.

3. US Dollar: An Attractive Currency During Recessions

Sharing similarities with gold, the US Dollar also boasts safe haven attributes. Due to its role as the world’s reserve currency and the backing of the world’s largest economy, the US Dollar is both incredibly liquid and sought after. Issued by the Federal Reserve, the Greenback is arguably the safest currency in the world and has become a quasi-currency of exchange in many nations where domestic currencies have had their purchasing power fall due to inflationary pressures or other economic woes.

Consequently, holding US Dollars during periods of uncertainty or turmoil is often viewed as an attractive alternative to other assets. Evidenced in the Great Financial Crisis when the United States dragged the rest of the world into a global recession, the US Dollar surged almost 25% during 2007 to 2009 even as the Federal Reserve lowered interest rates to the floor.

The Dollar’s strength was largely owed to the fact that the Federal Reserve possessed ample liquidity and the US economy was soon in a position to recover while others were mired in recessions - some of which have never fully recovered.

Recession Investments: Key Takeaways

With the benefit of hindsight and the lessons of the three most recent recessions, it can be argued the best recession investments are not stocks at all, but rather assets that retain their value even as growth slips. Therefore, if equity exposure is a must-have in your portfolio, the US Dollar and gold should also be given consideration – particularly for the risk averse investor or one who suspects an impending recession.

Other assets to consider adding to your portfolio during a recession are:

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX