The Strait of Hormuz and Oil Analysis - Talking Points:

- What is the Strait of Hormuz?

- Why is it Important?

- History of the Region’s Conflict

- Can Iran Close the Strait of Hormuz?

- How Does Local Pressure Impact Oil Prices?

What is the Strait of Hormuz?

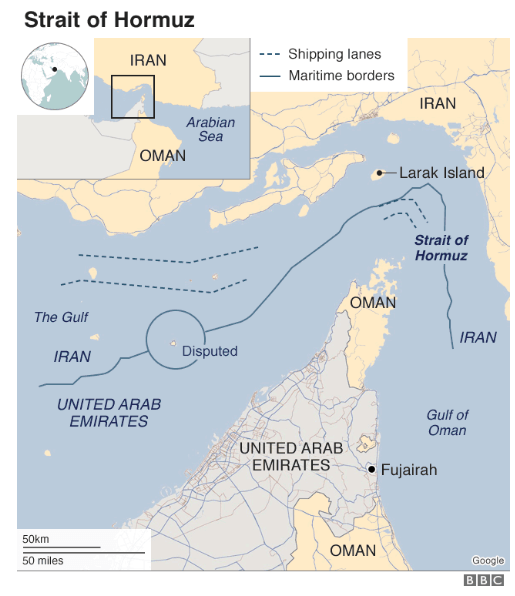

The Strait of Hormuz lies between Oman and Iran and is considered the world’s most important chokepoint. It is 21 miles wide at its narrowest point, while the shipping lanes in each direction are just two miles wide.

Source: BBC

Why is the Strait of Hormuz Important?

Over a third of global seaborne crude oil exports pass through the Strait of Hormuz with roughly 21 million barrels per day (mbpd) of crude, condensate and refined products from OPEC’s top five producers (Saudi Arabia, UAE, Kuwait, Iraq and Iran). The majority of the oil that flows through the Strait heads towards Asia, while Western nations also heavily rely on the supplies from the Strait.

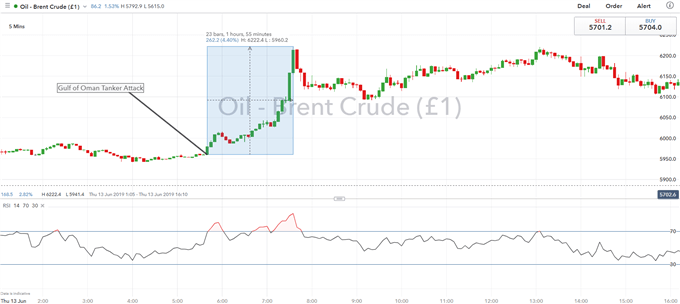

Typically, disruptions in the Strait can have a notable impact on trader sentiment in the oil complex. As a reminder, oil prices jumped over 4% in June 2019 when two attacks on tankers were witnessed in the Gulf of Oman.

Brent Crude Oil Price Chart: Five-Minute Timeframe (Intra-day)

Source: IG Charts

History of Conflict in the Strait of Hormuz

- 1980-1988: During the Iran-Iraq War, Iran threatened to close the Strait after Iraq disrupted shipping.

- 1988: The US Navy attacked Iran in retaliation for the Iranian mining of the Persian Gulf during the Iran-Iraq War.

- 2008: Iranian vessels had threatened three US Navy ships in the Strait.

- 2012 (Jan): Iran threatens to block the Strait of Hormuz in response to the US and European sanctions, which had been aimed at curtailing Iran’s nuclear programme.

- 2015 (May): A container ship had been seized by Iranian ships, while shots had been fired at a Singapore tanker, which Iran accused the tanker had damaged an oil platform.

- 2018 (July): Iranian President Rouhani states that Iran could disrupt oil flow through the Strait of Hormuz after the US calls to reduce Iran’s exports of oil to zero, following the withdrawal from the Iran Nuclear Accord.

- 2019 (May): Two Saudi oil tankers are attacked in the Gulf just outside of the Strait.

- 2019 (June): Iran shoots down a US drone

- 2019 (July): A US warship downs an Iranian drone in the Strait following its threat to the US Navy ship.Elsewhere, Iran seizes a British-operated oil tanker Stena Impero in the Strait.

Can Iran Close the Strait of Hormuz?

In theory, Iran could restrict traffic that enters the narrow passage. In December 1982, the UN Convention on the Law of the Sea had been signed, which defines territorial waters to a maximum of 12 nautical miles beyond each country’s coastline. In the Strait of Hormuz, vessels are forced to use the North and East routes in order to gain access to the Persian Gulf, which means they will be passing through Iranian waters.

However, disrupting shipments in the Strait of Hormuz would likely harm their own economy as Iran is heavily dependent on the right of free passage through the Strait. As a result, oil exports would be impacted, leaving the country to rely on its dwindling currency reserves Alongside this, Iran would be disrupting the exports of its neighbours, which in turn may further isolate the country.

That said, while Iran has threatened to close the Strait of Hormuz, actions towards closing the Strait would not only be seen as desperation but also not entirely feasible, given that it would damage its own economy. However, a closure of the Strait would push two global economic powerhouses – the US and Iran – towards outright war which would likely prompt a sizeable spike in oil prices.

Further reading to improve your oil trading:

- See our quarterly oil forecast to learn what will drive prices through mid-year!

- Read out in-depth guide to trading crude oil

- 8 Surprising Crude Oil Facts Every Trader Should Know

- WTI vs Brent: Top 5 Differences Between WTI and Brent Crude Oil

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX