US DOLLARFUNDAMENTAL FORECAST: NEUTRAL

- US Dollar unable to hold up after touching six-week high

- Fundamental driver inconsistency leaves outlook clouded

- Risk trend conviction needed, January FOMC minutes due

Gain confidence in your US Dollar trading strategy with our free guide!

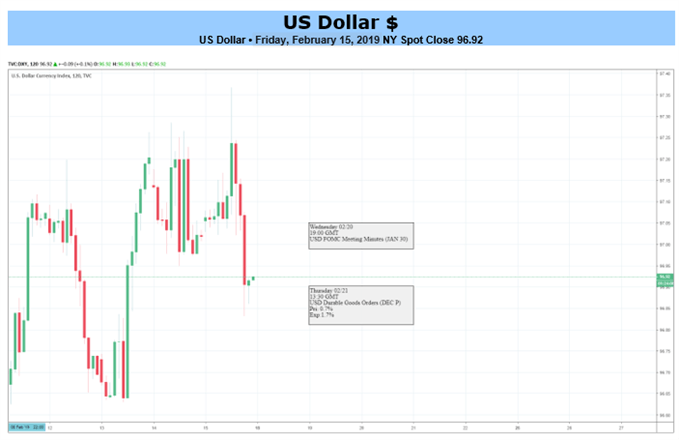

The US Dollar attempted to extend higher last week, touching a six-week high against an average of its major currency counterparts. The move would not prove lasting however, with prices erasing gains to finish Friday’s session in essentially the same place as Monday’s trade began.

Seesawing performance seems to reflect fundamental cross-currents competing for influence over the Greenback. It can find an appeal in a superior yield profile in risk-on trade or leverage its unrivaled liquidity to attract haven demand when the pendulum swings to a risk-off setting.

Sentiment trends need to remain at least somewhat consistent for either dynamic to build discernible traction. When that is not the case – and last week was a case in point for inconsistency – a clear-cut narrative with follow-on potential is difficult to divine.

The domestic front is unlikely to offer clarity in the week ahead. Minutes from January’s FOMC meeting amount to the only bit of top-tier event risk, and they seem unlikely to offer much beyond the “wait-and-see” narrative that Fed officials have presented in a steady stream of recent commentary.

That means a decisive break is likely to need commitment from risk appetite. With mixed reviews of progress in US-China trade talks and reinforcement of global slowdown fears in recent data flow, the path of least resistance probably leans in favor of de-risking. If it can be sustained, USD might find fuel for gains.

Looking for a technical perspective on USD? Check out the Weekly USD Technical Forecast.

--- Written by Ilya Spivak, Sr. Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

US DOLLAR TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

OTHER FUNDAMENTAL FORECASTS:

Australian Dollar Forecast –May Head Lower If RBA Jawboning Starts Anew

British Pound Forecast – Sterling Struggles as the Brexit Clock Ticks

Gold Forecast – Gold Bull-Flag Formation Continues to Unfold Ahead of FOMC Minutes