Talking Points

- Second Yuan Devaluation Part of “New Normal” for China

- PBOC Likely to Continue Reducing Yuan Reference Rate

- Interested in Trading the Chinese Yuan? Learn More Here

The People’s Bank of China (PBOC) surprised markets when it announced a 1.9 percent devaluation of the Yuan reference rate yesterday, marking the largest such move since the “crawling peg” FX regime was introduced in 2005. Officials called the change a one-off realignment to bring the effective exchange rate closer to market expectations. Needless to say, the markets were more than a little surprised when the central bank slashed the reference rate by a further 1.6 percent today.

From here, the obvious questions for investors are: how did a “one-off” adjustment turn into a second day of devaluation, and will more cuts in the reference rate follow?

The answer to the former question is found in the details of yesterday’s announcement. The PBOC introduced a new strategy for setting the daily reference rate in addition to slashing it. Specifically, officials said that they will now take market forces into account to set the daily fix.

Yesterday’s 1.9 percent devaluation in the on-shore CNY rate translated into a 2.8 percent drop in CNH, the market-driven offshore version of the Yuan. This suggested the markets favored the currency lower, prompting today’s adjustment. Importantly, the magnitude of today’s daily fix change doesn’t line up with the disparity in yesterday’s USDCNY and USDCNH moves, so the precise algorithm yielding a 1.6 percent shift today is unclear.

The answer to the latter question follows from the former. Today’s jump in USDCNH is on pace to top the move in USDCNY by about 1 percent. If the disparity holds through the end of the trading day, another reference rate revision seems likely tomorrow. This will presumably continue until USDCNH stabilizes and violent reactions to changes in the daily fix fade along with the novelty of China’s updated FX policy.

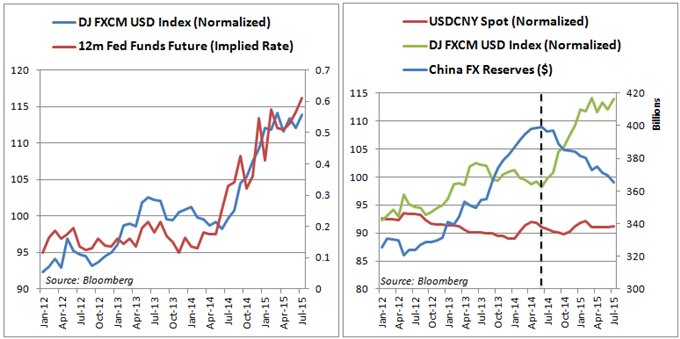

When will that happen? A precise answer is difficult to pin down, but traders can get a sense of the magnitudes at work. As we noted yesterday, China has spent close to $300 billion out of FX reserves over the past 13 months to keep USDCNY stable even as the US Dollar rallied on the back of building Federal Reserve interest rate hike expectations (see chart below).

Crudely estimating the impact of China’s intervention since mid-2014 suggests the Yuan was about 10 percent stronger against the US Dollar heading into August than it would have been otherwise. This hints that the PBOC may be just a third of the way through the revaluation process, pointing to more downward revisions in the reference rate ahead. Whether these will come in increments of nearly 2 percent again remains unknown, as does the moves’ continued potency in fueling volatility.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak