Gold, USD/JPY, AUD/USD Talking Points

- This morning’s NFP report was strong all-around.

- This has mattered little, as risk aversion themes continue to show.

- Coronavirus fears remain, and current price action appears as corrective to earlier-week themes of risk-on behavior.

Gold Rallies, US Dollar Drops on Strong NFP Report

It’s been a busy morning already after the release of a really strong Non-Farm Payrolls report for the month of January. As recapped by our own Austin Sealey earlier this morning, January NFP’s printed at +225k versus the expectation for +160k. Average Hourly Earnings came in at 3.1% versus the 3% expectation; and the unemployment rate ticked-up slightly due to greater labor force participation, printing at 3.6% versus the multi-decade lows of 3.5% from last month.

The net response so far has been USD-weakness as US equities have gapped-down. Gold prices have continued to tick-higher after this week’s support test, and WTI crude oil prices remain perilously close to the 50-psychological level. Given this collection of themes, it would appear that there’s a harboring fear around the continued spread of coronavirus; and considering the fact that we’re approaching a weekend in which risk-on themes remain vulnerable to new headlines or items around this scenario, it makes sense as to why a bit of a risk-off tone has since shown.

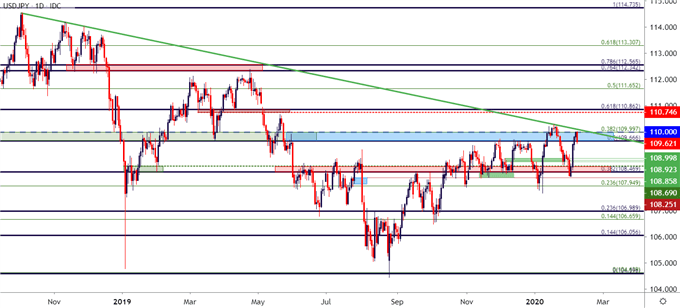

As looked at in yesterday’s webinar, one market that could remain particularly compelling around continued risk aversion is USD/JPY. The US Dollar put in a significant run of strength in the first four trading days of February, finally finding a bit of resistance on Friday that’s played-out through the NFP release. But, in USD/JPY, that US Dollar strength merely propelled the pair up to a key zone of resistance that held multiple inflections over the past month; with buyers pulling up short of the prior swing-high.

This can help to keep USD/JPY as an interesting option for scenarios of USD-weakness.

USD/JPY Daily Price Chart

Chart prepared by James Stanley; USDJPY on Tradingview

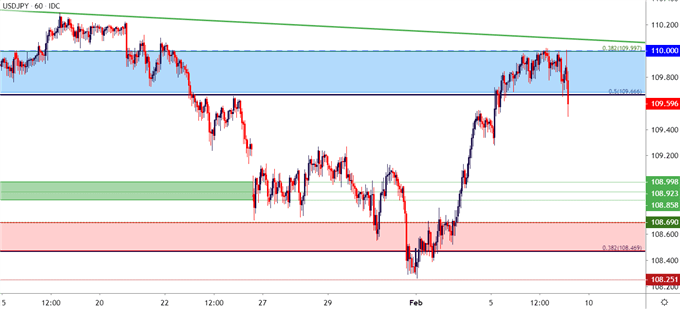

With the addition of this morning’s weakness in the US Dollar after NFP, sellers have already begun to work on that next lower-low, keeping the door open for bearish potential in the pair.

| Change in | Longs | Shorts | OI |

| Daily | 4% | -7% | -4% |

| Weekly | 93% | -36% | -19% |

USD/JPY Hourly Price Chart

Chart prepared by James Stanley; USDJPY on Tradingview

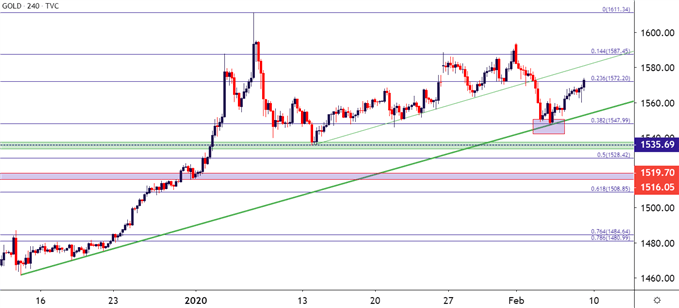

Going along with that theme of risk aversion, Gold prices have put in a really strong past couple of days, even as USD-strength remained a notable item ahead of this morning’s NFP release. After starting the week with a brisk sell-off as risk aversion fears took a back seat, Fibonacci support showed up in Gold prices around 1548, which helped to arrest the lows; and buyers have largely been in-control ever since.

That Fibonacci support is the 38.2% retracement of the November-January move; and currently the 23.6% marker of that same Fibonacci study is coming in to set near-term resistance.

| Change in | Longs | Shorts | OI |

| Daily | -6% | -5% | -6% |

| Weekly | -2% | -9% | -5% |

Gold Four-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

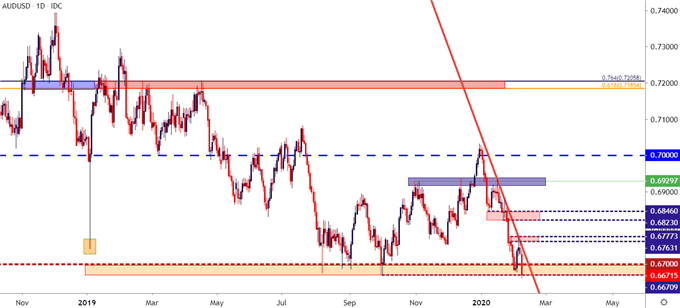

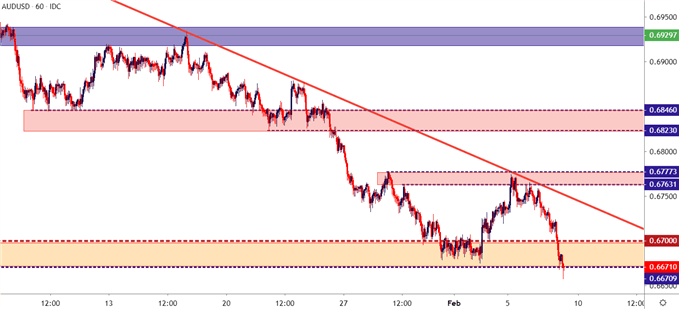

AUD/USD Sets Fresh Decade Lows – Then Stalls

As looked at over the past few weeks, AUD/USD remained attractive for long-USD strategies. With fear continuing to show, the pair broke down to a fresh 10-year low earlier this morning, even as USD was pulling back after the NFP report.

AUD/USD Daily Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

This week’s price action was marked by a move to a key zone of resistance, at which point sellers came back into the matter to re-take control of the trend. Similar to the above scenarios, it appears as though there’s a bit of alignment with the risk aversion trade; with growing fears of coronavirus bringing more bears into the mix.

| Change in | Longs | Shorts | OI |

| Daily | -18% | 6% | -7% |

| Weekly | -21% | 26% | -3% |

AUD/USD Hourly Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX