Gold Price Analysis

- Gold prices gapped-higher to start this week.

- Fear drove the bid in Gold through last week.

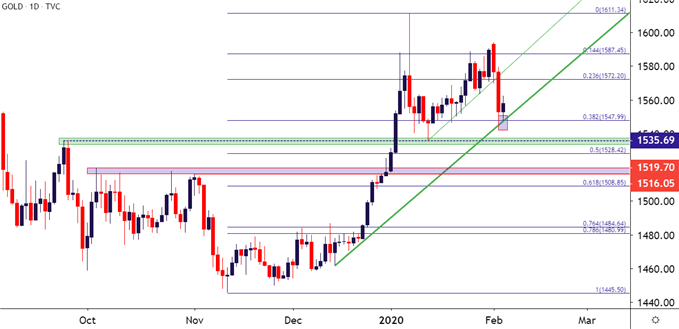

- Gold price action has started pulling back, finding support at a Fibonacci level.

Gold Price Action Begins Pullback, Finds Fibonacci Support

It’s turning into a nasty week for Gold bulls, even after the yellow metal gapped-up to fresh highs on the Sunday open. Sellers came in and haven’t relented much as price action has fallen by almost 3% so far this week; and this follows the bullish bounce after last week’s FOMC rate decision. There remains considerable headline risk for the rest of this week, with Friday’s NFP report looming large, and also the ongoing-yet-difficult to navigate Coronavirus, which can bring a fear bid back into Gold at any time.

At this point, Gold prices are finding support at a Fibonacci level of interest, as this is the 38.2% retracement of the November-January major move. This was looked at as secondary support in Gold last week, just ahead of the FOMC bump; and a week later this level has come back into play with a slightly different context.

Gold Four-Hour Chart

Chart prepared by James Stanley; Gold on Tradingview

As looked at previously, there are a few bullish factors driving Gold prices, most recently of which has been the build of fear around the continued spread of Coronavirus. As those fears have dissipated in the early-portion of this week, further evidenced by the recovery in Oil prices and the ascension of US equities back towards all-time-highs, Gold prices have folded lower to erase prior gains.

| Change in | Longs | Shorts | OI |

| Daily | 8% | -3% | 2% |

| Weekly | 11% | -7% | 1% |

There still remains items of interest for Gold buyers, however, chief of which has been the build of rate cut expectations around the FOMC and falling yields in the US. This was the core of the rationale for naming Gold as one of my Top Trade Ideas for 2020; but the recent entrance of fear obfuscated that fact as another motive began to take-over. But, with that fear getting priced-out to some degree, the question remains: Where will longer-term bulls step in to set support in Gold prices? The current area appears to be a pause, and given the build of lower-lows and lower-highs, this support may not hold for much longer, particularly as a couple of key headline items cross the wires on Friday morning.

The price of 1535 remains of interest, as this currently marks the 2020 swing-low in Gold prices. I had looked at this as a potential support area earlier this year after Gold broke-out to start 2020 trade; and this price helped to bring buyers back into the mix as that bullish theme ran through this week’s open. That level remains of interest, and a bit deeper is another area of interest around the 1515-1520 zone; this zone similarly helped to set resistance last year and, to date, hasn’t seen much for support tests. Should this pullback really get going, that deeper support level could offer potential for short-term reversal scenarios, looking in the direction of the longer-term trend.

Gold Daily Chart

Chart prepared by James Stanley; Gold on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX