Talking Points:

- Dollar calm ahead of Wednesday FOMC with priced in rate hike, eyes on next move

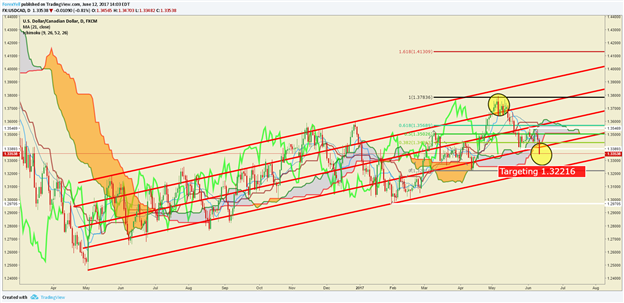

- CAD sees gains compound on Wilken’s of BoC comment about preparation for possible hikes

- Sterling value concerns growing, breakdown below 1.26 worrisome on charts

- Sentiment Highlight: DAX longs believe in long-term Bull trend

The US Dollar news on Monday was centered not on an economic announcement or new release, but rather a 3-year Treasury auction. The 3-Yr US Treasury auction showed the highest action from indirect bidders, typically foreign central banks and mutual funds since 2009 per Bloomberg. The rise in interest would argue that there is a continued run toward quality over growth as the Nasdaq is working on a near 4% decline in recent trading sessions. Also worrisome is the flattening 2/10Yr US yield curve spread, which argues doubts over inflation and growth, which are both needed to encourage the Fed to reach their median dot plot forecast of 3.00%. Traders will listen on Wednesday to see whether the Fed believes they are still on pace for multiple hikes this year and next or whether they’re about to tune down their forecast, which would likely weigh on the USD.

A positive standout in today’s G10 landscape is the Canadian Dollar. The Canadian Dollar jumped across the board to become the day’s strongest currency after the Bank of Canada’s Carolyn Wilkens said how the central bank needs to be prepared to react to the nations broadening recovery that has encouraged policy makers and opening the door to the preparation of reduced stimulus and likely future rate hikes.

Would you like to know what our top minds are watching over the long-term in markets?

On the other side of the spectrum, the positive performance of the Canadian Dollar is the British Pound. Traders are likely actively looking for ways to play further GBP weakness whether through commodity exposure or against the JPY as GBP/JPY broke below the 200-DMA at 138.93. GBP is expected to trade on the defensive and is more likely to be played under the credo, “sell first and ask questions later,” on increasing political doubt after the UK election means that PM May is no longer leading Brexit negotiations with a majority government.

JoinTylerin his Daily Closing Bell webinars at 3 pm ET to discuss tradeable market developments.

Where are the trades to be found among the low-volatility environment? Find out here !

Closing Bell’s Top Chart: June 12, 2017, USD/CAD resumes Friday’s moves with BoC Wilkin’s comments

Tomorrow's Main Event: GBP Consumer Price Index (YoY) (MAY)

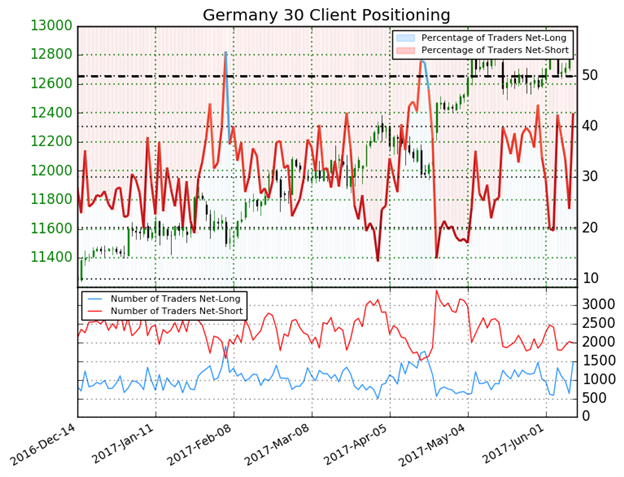

IG Client Sentiment Highlight: DAX longs believe in long-term Bull trend

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

Germany 30: Retail trader data shows 42.6% of traders are net-long with the ratio of traders short to long at 1.34 to 1. In fact, traders have remained net-short since May 25 when Germany 30 traded near 12665.0; theprice has moved 0.1% higher since then. The number of traders net-long is 86.6% higher than yesterday and 114.2% higher from last week, while the number of traders net-short is 21.8% lower than yesterday and 15.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Germany 30 prices may continue to rise. Traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current Germany 30 price trend may soon reverse lower despite the fact traders remain net-short.(Emphasis mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell