US Durable Goods Orders Report Overview

- The preliminary March US Durable Goods Orders report is due on Monday, August 26 at 12:30 GMT and the data should help further stabilize the rebound in US growth expectations seen in recent days.

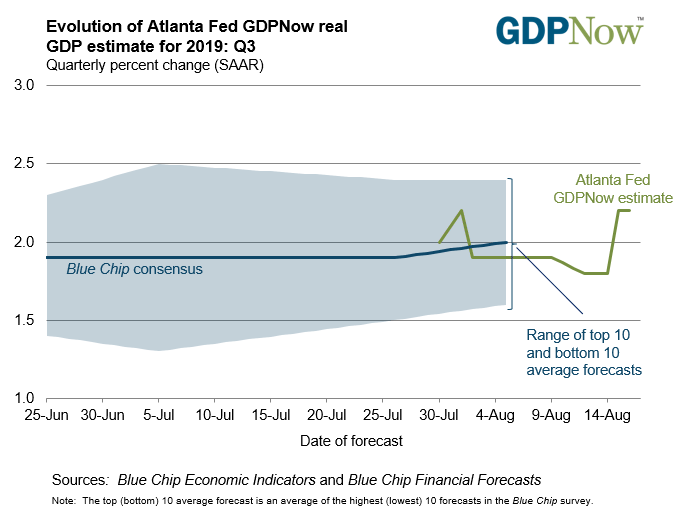

- The Atlanta Fed GDPNow forecast is looking for Q3’19 US GDP at 2.2% after hitting a low of 1.8% in the second week of August.

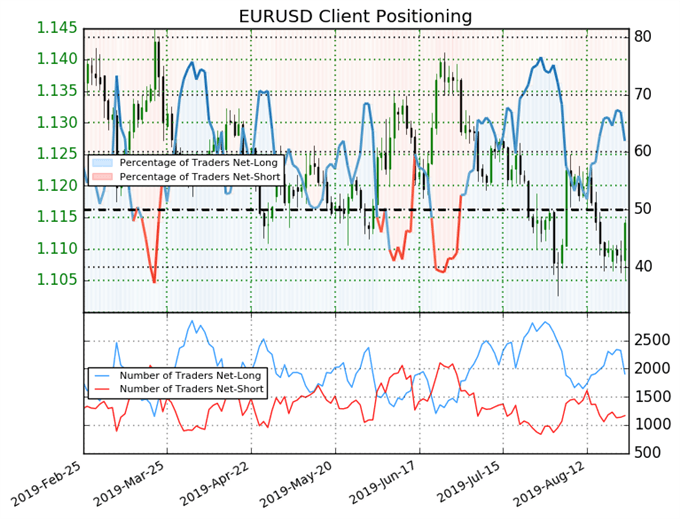

- Retail traders have remained net-long since July 1 when EURUSD traded near 1.1366; price has moved 2.0% lower since then.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

08/26 MONDAY | 12:30 GMT | USD Durable Goods Orders (JUL P)

The US economy revolves around consumption trends, given that approximately 70% of GDP is accounted for by the spending habits of businesses and consumers. As such, the durable goods orders reportmake for an important barometer of the US economy.

Durable goods are items with lifespans of three-years or longer – from refrigerators and washing machines to cars and airplanes. These items typically require greater capital investment or financing to secure, meaning that traders can use the report as a proxy for business’ and consumers’ financial confidence and health.

The preliminary July print is expected to show a gain of 1.1% after the 1.9% drop in June.

Atlanta Fed GDPNow Q3’19 US GDP Forecast (August 23, 2019) (Chart 1)

The durable goods orders reportcould help further stabilize the rebound in US growth expectations seen in recent days. Based on the information received thus far about Q3’19, the Atlanta Fed GDPNow forecast is looking for growth at 2.2% after hitting a low of 1.8% in the second week of August. The next update to the Q3’19 forecast will be released after Monday’s US economic data.

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

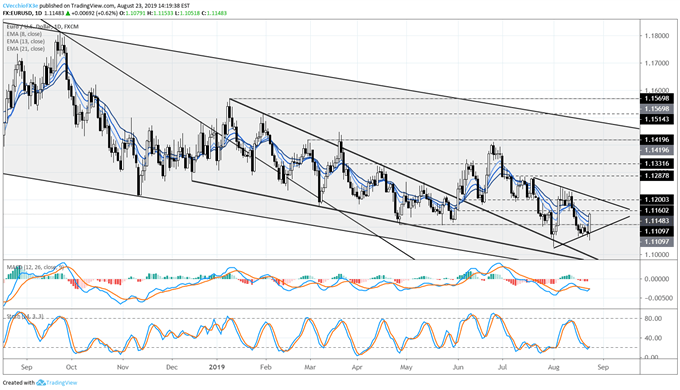

EURUSD Technical Analysis: Daily Price Chart (August 2018 to August 2019) (Chart 2)

In our last EURUSD technical forecast update, it was noted that “in a symmetrical triangle pattern, the bias is neutral as momentum is flat…it’s too soon to say that the symmetrical triangle is not part of a continuation effort to new lows rather than a bottoming attempt.” Patience has proven a virtue once again, as the attempt by EURUSD to breakdown out of the symmetrical triangle has been thwarted in the form of a bullish key reversal/outside engulfing bar on the daily timeframe.

With the daily bullish key reversal/outside engulfing bar forming, EURUSD now appears likely to make a return to triangle resistance closer towards 1.1200. Price is now above the daily 8-, 13-, and 21-EMA envelope, while daily MACD and Slow Stochastics have turned higher (albeit still in bearish territory). The symmetrical triangle pattern is still neutral, but traders may want to focus on the topside potential once more.

IG Client Sentiment Index: EURUSD Price Forecast (August 23, 2019) (Chart 3)

EURUSD: Retail trader data shows 61.9% of traders are net-long with the ratio of traders long to short at 1.63 to 1. In fact, traders have remained net-long since July 1 when EURUSD traded near 1.1366; price has moved 2.0% lower since then. The percentage of traders net-long is now its lowest since Aug 16 when EURUSD traded near 1.10898. The number of traders net-long is 17.9% lower than yesterday and 13.1% lower from last week, while the number of traders net-short is 2.5% lower than yesterday and 1.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse higher despite the fact traders remain net-long.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX