August RBA Meeting Minutes Overview:

- The August RBA meeting minutes are due to be on Tuesday, August 20 at 01:30 GMT, and the tone is likely to come in on the dovish side.

- However, September RBA meeting interest rate cut odds have fallen in recent weeks, so any AUDUSD weakness around the minutes may be short-lived.

- Retail traders have remained net-long since July 19 when AUDUSD traded near 0.7012; price has moved 3.2% lower since then (no change over the past week).

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

08/20 TUESDAY| 01:30 GMT | AUD AUGUST RESERVE BANK OF AUSTRALIA MEETING MINUTES

Prior to the August Reserve Bank of Australia meeting, there was a 44% chance of a 25-bps interest rate cut in September. After the August RBA meeting, at the end of last week, there was a 47% chance of a 25-bps rate cut. But with US President Donald Trump announcing a détente in the US-China trade war – the proposed 10% tariffs on $300 billion of imported Chinese goods has been delayed from September 1 to December 15 – speculation around major central banks’ easing cycles has been severely curbed.

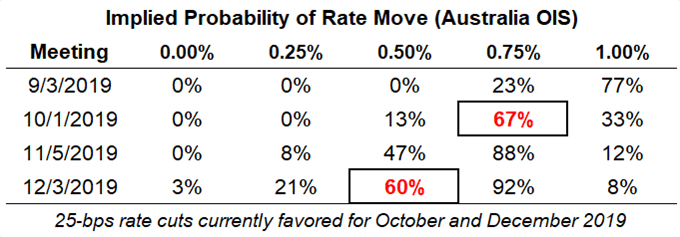

Reserve Bank of Australia Interest Rate Expectations (August 16, 2019) (Table 1)

Now, interest rate markets have eased off those dovish expectations compared to where they were before and immediately after the August RBA meeting. There is a 77% chance of no change in rates at the September RBA meeting. If the August RBA meeting minutes produce weakness in AUDUSD, it may be limited given that the tone around the US-China trade war has evolved.

That said, rates market continue to foresee two 25-bps rate cuts by the end of the year: there is a 67% chance of the first 25-bps rate cut coming in October and a 60% chance of the second 25-bps rate cut coming in December.

Pairs to Watch: AUDJPY, AUDNZD, AUDUSD

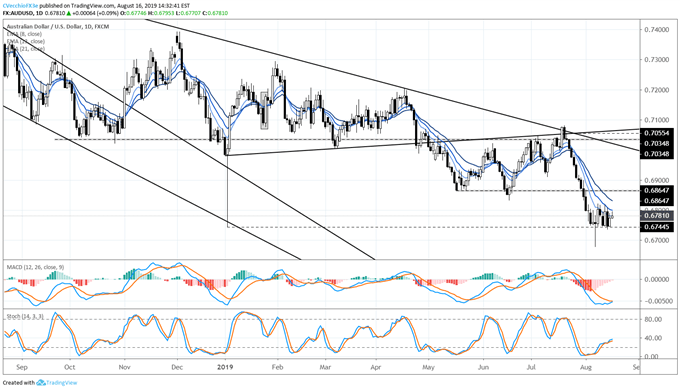

AUDUSD Technical Analysis: Daily Timeframe (August 2018 to August 2019) (Chart 1)

In our last AUDUSD technical forecast, it was noted that “until the daily 8-EMA is breached – AUDUSD has closed below it every session since July 23 – there is little reason to look higher.” The daily 8-EMA was breached with a close above it on August 13, even though there has yet to be follow through to the topside. Now, the daily 13-EMA is shoring up resistance; it has not been breached since July 23 on a closing basis either.

While AUDUSD is still below its daily 8-, 13-, and 21-EMA envelope, daily MACD has turned higher (albeit in bullish territory) while Slow Stochastics continue to climb towards neutral. Although the bias may still be for lower AUDUSD prices, traders may want to see how the recent high/low range between 0.6736 and 0.6822 breaks before choosing a direction.

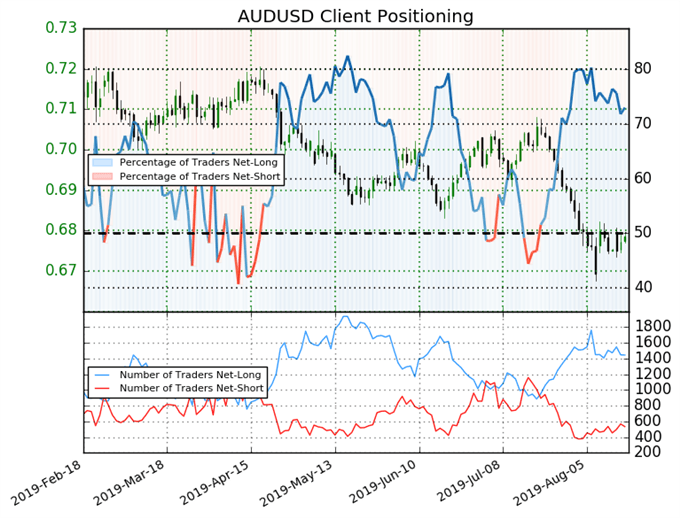

IG Client Sentiment Index: AUDUSD Rate Forecast (August 16, 2019) (Chart 2)

AUDUSD: Retail trader data shows 73.0% of traders are net-long with the ratio of traders long to short at 2.7 to 1. In fact, traders have remained net-long since July 19 when AUDUSD traded near 0.7012; price has moved 3.2% lower since then. The number of traders net-long is 1.0% lower than yesterday and 3.6% lower from last week, while the number of traders net-short is 5.3% lower than yesterday and 1.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUDUSD-bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX