Talking Points:

- The April US Change in Nonfarm Payrolls report is due on Friday at 12:30 GMT.

- Markets are expecting the rebound in jobs growth to continue, with headline NFP coming in at 185K.

- Retail traders are selling the US Dollar, despite price breaking to a fresh 2019 high last week.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

05/03 FRIDAY | 12:30 GMT | USD Change in Nonfarm Payrolls & Unemployment Rate (APR)

The US labor market remains a pillar of strength for the US economy, and all signs pointed to another solid jobs expansion in April. Following the print of 196K in March, Bloomberg News’ consensus forecast is looking for 185K jobs to have been added in the fourth month of the year. As a result, forecasts point to the unemployment rate staying on hold at 3.8%, a multi-decade and cycle low.

Another solid US jobs report could be another piece of evidence to suggest that rates markets are priced far-too-dovish. Even after the Q1’19 US GDP report showed growth at 3.2% annualized, Fed funds futures are pricing in nearly a two-in-three chance that a 25-bps rate cut comes by December 2019. As it were, a strong April US NFP report could give reason for rates markets to push back against a rate cut, in turn, helping lift the US Dollar.

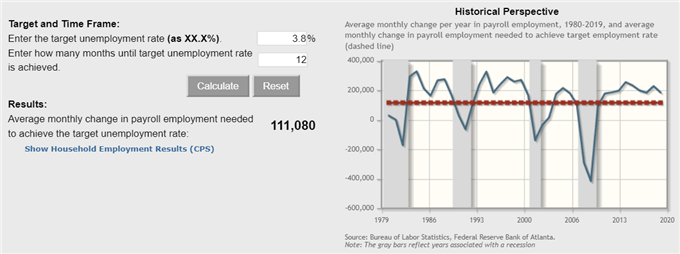

According to the Atlanta Fed Jobs Growth Calculator, the economy only needs +111K jobs growth per month over the next 12-months to sustain said unemployment rate at its current 3.8% level.

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

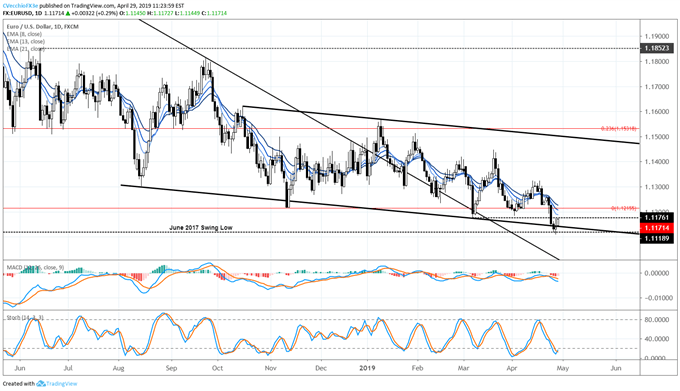

EURUSD Technical Analysis: Daily Price Chart (May 2018 to April 2019) (Chart 1)

After falling to its lowest level since June 2017, EURUSD prices have started to rebound following their break down to fresh 2019 lows last week. Mirroring the pullback in the DXY Index breakout, now the question is whether or not US Dollar strength – and in turn, Euro weakness – will remain in vogue. To this end, the near-term technical forecast for EURUSD remains bearish so long as price remains below the daily 8-EMA, currently at 1.1191 – which would also represent a return back above the former 2019 low and March swing low at 1.1176.

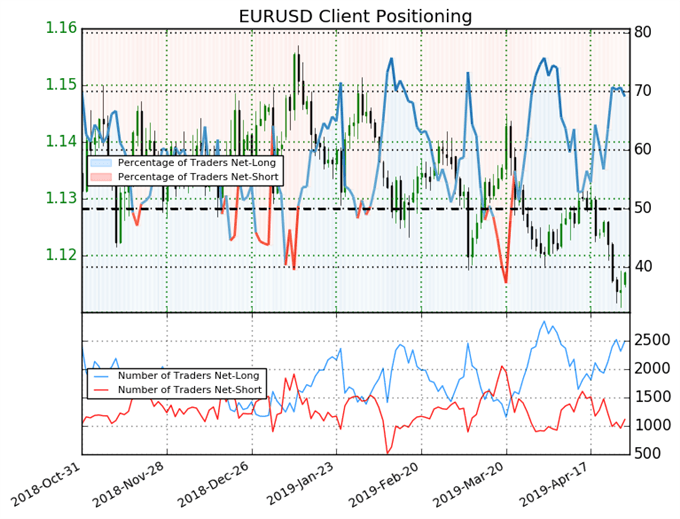

IG Client Sentiment Index: EURUSD (April 29, 2019) (Chart 2)

Retail trader data shows 72.2% of traders are net-long with the ratio of traders long to short at 2.59 to 1. In fact, traders have remained net-long since Mar 26 when EURUSD traded near 1.12738; price has moved 0.5% lower since then. The number of traders net-long is 1.7% lower than yesterday and 26.1% higher from last week, while the number of traders net-short is 10.5% higher than yesterday and 16.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX