Talking Points:

- The April Bank of Japan meeting is set to conclude on Thursday, April 25, sometime after 1:00 GMT.

- Surprise action taken by the BOJ on Friday, April 19 to cut bond purchases suggests that the BOJ will stand pat at its April meeting.

- Recent changes in retail trader positioning suggest that EURJPY may soon reverse lower.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

04/25 THURSDAY | ~01:00 GMT | JPY Bank of Japan Rate Decision

The Bank of Japan remains mired in its three-decade war of attrition with deflationary pressures, and 2019 has yet to prove successful in getting topline inflation readings back towards the BOJ’s medium-term target of +2%.The March National Japanese CPI report came in at a paltry0.5%, the core inflation reading (ex-fresh food) came in at 0.8%, and the core-core inflation reading (ex-fresh food and ex-energy) came in at 0.4% (y/y). It’s fairly predictable that the BOJ will remain one of the world’s most dovish central banks for the foreseeable future.

Ahead of the April BOJ meeting, policymakers opted to surprise market participants on Friday, April 19 with a cut to their bond purchase program from ¥180 billion per month to ¥160 billion per month. With policy so predictable – the whole world knows about Japan’s multi-decade battle with deflation – the only way the BOJ can effectively implement its monetary policy is via surprise. The surprise action to cut bond purchases reinforces the idea that the BOJ will stand pat at its April meeting.

Pairs to Watch: AUDJPY, EURJPY, USDJPY

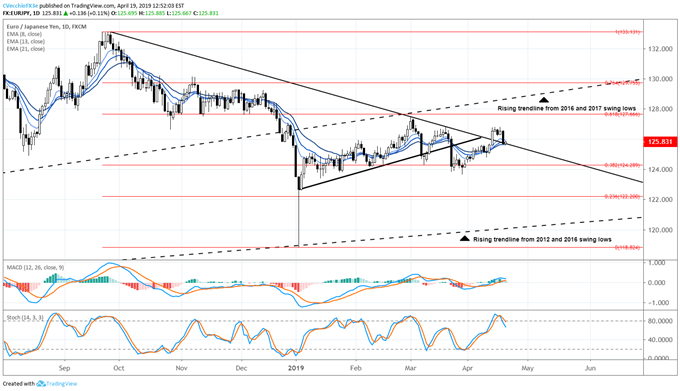

EURJPY Technical Forecast: Daily Price Chart (January 2018 to April 2019) (Chart 1)

The attempt by EURJPY prices for a topside breakout is on the precipice of failure. Despite having cleared out the downtrend from the September 2018 and March 2019 swing highs through the second week of April, EURJPY has fallen back to its daily 8-, 13-, and 21-EMA envelope now. Slow Stochastics have turned lower and are no longer in overbought territory; daily MACD has started to narrow and point lower. The next few days will prove critical; a move back below the daily 21-EMA (currently 125.66) would represent a move back below the downtrend from the September 2018 and March 2019 swing highs and warrant a bearish forecast for EURJPY prices.

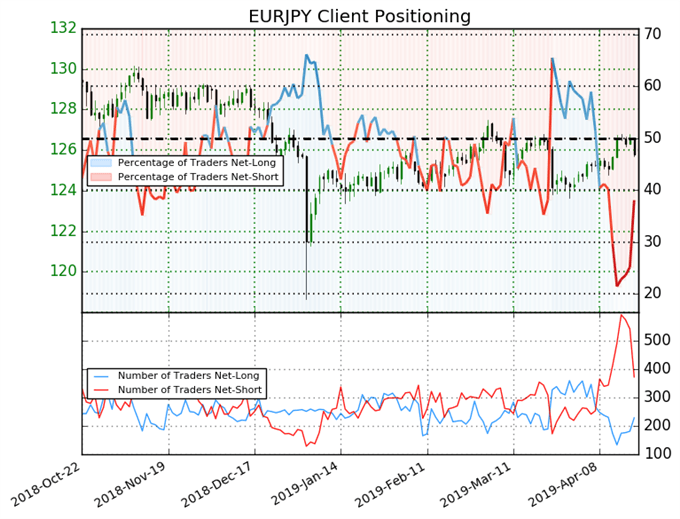

IG Client Sentiment Index: EURJPY (April 19, 2019) (Chart 2)

EURJPY: Retail trader data shows 38.0% of traders are net-long with the ratio of traders short to long at 1.63 to 1. In fact, traders have remained net-short since Apr 08 when EURJPY traded near 125.473; price has moved 0.3% higher since then. The percentage of traders net-long is now its highest since Apr 11 when EURJPY traded near 125.662. The number of traders net-long is 11.2% higher than yesterday and 15.1% higher from last week, while the number of traders net-short is 31.9% lower than yesterday and 8.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURJPY prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURJPY price trend may soon reverse lower despite the fact traders remain net-short.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX