Talking Points

-Fed rate hike expectations increase slowly, but still suggest no hike until 2017

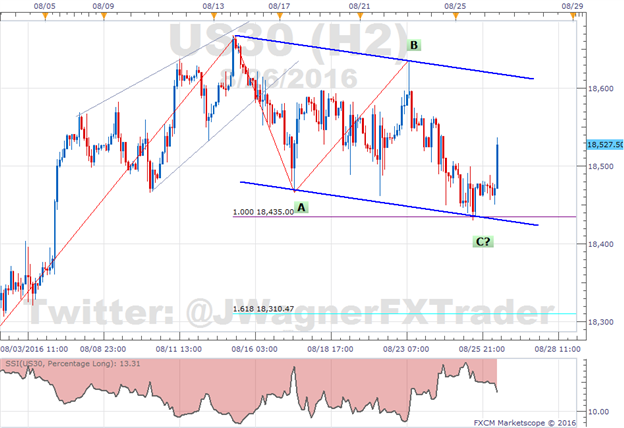

-Dow Jones Industrial Average (DJIA) continues trading in a tight 415 point range on low volatility

-Technical picture remains bullish above 17,800

The Fed continues to talk up the potential for near term rate hikes. According to the Fed Fund futures, odds of a September rate hike have increased but are still at 30%. The odds of a December 2016 rate hike is slowly increasing, now up to 55%. These moves have failed to inspire a break of the trading range in DJIA.

DJIA continues to trade in a tight range between 18,250 and 18,665. One technical price pattern has developed since August 15 which is beginning to make things interesting for Dow Jones Industrial Average.

The move from August 15 to yesterday’s low carved out an equal wave pattern. If there is any bullish juice in this drink, now would be a time for it to appear. A break above the resistance trend line near 18,600 would build the case for higher highs towards 19,700.

On the other hand, a material break below 18,400 opens the door towards lower levels of 18,300 and 18,100.

Chart prepared by Jeremy Wagner

Let’s not lose sight of the medium term outlook. DJIA is still hovering near all-time highs. Therefore, we can continue to see the medium term outlook as bullish and dips in price as buying opportunities. A break below 17,800 becomes a warning light on the dashboard that we need to give more weight to other bearish scenarios.

Learn how leverage affects trading results in our Traits of Successful Traders research.

Interested in a longer term outlook for equities? Download our quarterly forecast here.

Good luck!

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX EDU

Follow me on Twitter at @JWagnerFXTrader .

See Jeremy’s recent articles at his Bio Page.

To receive additional articles from Jeremy via email, join Jeremy’s distribution list.