Talking Points

-Dow Futures down 0.6% after 2 days in a row of losses for DJIA

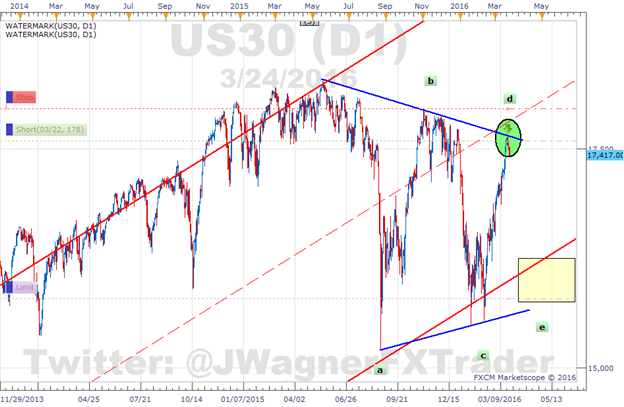

-Triangle pattern is our analog for price suggesting another 5-7% selloff

-DJIA support near 16,500 and possibly 15,750

Dow futures are down about 0.6% this morning after 2 days in a row of losses for DJIA. The anticipated reversal for Dow Jones appears technical in nature such that a host of resistance was seen as profit taking opportunity on the 14% run higher since February 11.

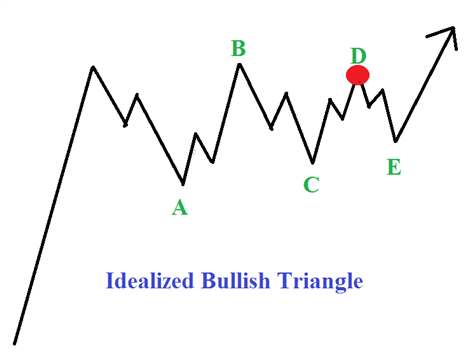

The pattern we are using as an analog is a triangle pattern (see idealized pattern below). This would suggest Dow Jones gives back about 5-7% of the gains which may open the door for another bullish run in the coming weeks.

On Tuesday, we identified target levels 16,500 and 15,750 for a selloff on the US30, a CFD which tracks the DJIA. 16,500 is near where the 200 day simple moving average resides. A more aggressive lower level of 15,750 is watched if the February 11 low were tested.

The sentiment of traders in the US30 show bulls are rushing in while bears head for the exits. Long positions are 41.5% higher than yesterday while short positions are 16.7% lower during the same stretch. This provides another clue that the selloff may have some legs as traders typically position on the wrong side of the trade. (For more on trading with sentiment, watch this 5 minute video.)

Dow Jones (ticker: US30) Selloff Has Room to Run

Created using FXCM’s Marketscope charts

We never know for sure if the anticipated move will work in our favor. For the time being, risk levels can be set at 18,000 and we’ll look to lower the risk to better than break even if the DJIA continues to fall.

If we are completely wrong and prices were to accelerate above 18,000, then we might consider a stop and reverse to position to the long side. If we move closer to 18,000, we’ll share the alternative pattern as the triangle would be invalidated.

Lastly, be mindful that trading on NYSE will be closed on Good Friday, March 25.

Suggested Reading/Viewing:

Dow Jones Industrial Average 7 Day Win Streak at Risk

Introduction to Sentiment Trading [5 minute video]

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX EDU

Follow me on Twitter at @JWagnerFXTrader .

See Jeremy’s recent articles at his Bio Page.