Talking Points

- SSI is a positioning tool gauging market sentiment.

- Scalpers will use SSI extremes to identify Forex trends.

- An extreme negative GBPJPY SSI reading may lead to continued bull trend bias.

SSI (Speculative Sentiment Index) is a proprietary trading tool offered to FXCM clients through DailyFX PLUS. This tool has been adapted for Forex currency pairs and CFD contracts and its primary use is to confirm market trends. Once you have familiarized yourself with SSI, it is a great component to work into any existing scalping strategy. Today we will work to get up to speed with this resource, while looking at its uses in day trading.

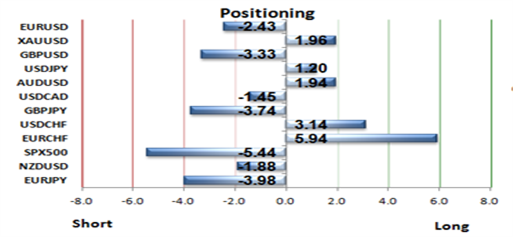

Learn Forex – Current SSI Readings

SSI and Scalping

First, SSI is a calculated ratio that gives us a snapshot of trader positioning while giving hints on market direction. SSI reveals trader positioning by determining if they are net long or short a currency pair, and if so by how much. Above we can see SSI as displayed through DailyFX Plus. With the GBPJPY reading at -3.74, this means there are 3 and 3/4 positions short for every position that is long. The higher this number becomes, the more extreme SSI is considered.

As a scalper the number one priority is to find the Trend. As most traders attempt to fade trends, scalpers should use a contrarian approach to SSI. This means if SSI has extreme negative reading, like on the GBPJPY, traders should look for the trend to be upward. Conversely if SSI has an extreme positive reading that means the majority of positions are likely to be fading an existing downtrend.

Let’s take a look at SSI in action.

Learn Forex – Current GBPJPY Trend

SSI and the GBPJPY

Currently we can see that the GBPJPY trading 483 pips higher from its November the 5ths low at 156.93. As this trend has ramped up, the majority of traders have been selling into strength attempting to find a top to the pair. As selling positions have increased, this has signaled new BUYING opportunities for scalpers. The key to remember is that a negative reading of SSI indicates that a strong uptrend is in play. Once this is established traders can assume the strategy of their choosing.

When adding any new component to an existing strategy it is always important to track your progress. You can do this easily, by running a report inside the FXCM Trading Station. Then, review your progress and see if SSI and scalping is for you!

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information

New to the FX market? Save hours in figuring out what FOREX trading is all about.

Take this free 20 minute “New to FX” course presented by DailyFX Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HERE to start your FOREX learning now!